Clark County Public Communications

In a video of the county’s home auction Thursday, an auctioneer takes bids. The roughly 190 people who showed for 24 properties weren’t as freewheeling as Californians at a recent auction there.

Friday, April 17, 2009 | 2 a.m.

Reader poll

Sun Archives

- Henderson working out details of $4 million foreclosure program (4-16-2009)

- Nevada leads nation as foreclosures set record in March (4-15-2009)

- Fighting the foreclosures (4-12-2009)

- Home prices key to economic turnaround, economist says (30-6-2009)

- Report: 58.2 percent of Las Vegas homes have negative equity (3-4-2009)

- ‘More pain to come in this Vegas land market’ (3-1-2009)

- New-home sales plummet again with no signs of improvement (2-27-2009)

- Las Vegas counts on Obama housing rescue (2-27-2009)

- Report: Las Vegas home prices at July 2003 levels (2-24-2009)

- Economist: Vegas housing market to recover in 2010 (2-23-2009)

- How Obama's mortgage relief plan pencils out (2-21-2009)

Sun Topics

The fire sale atmosphere in the usually staid Clark County Commission chambers belied the seriousness of what was happening Thursday morning.

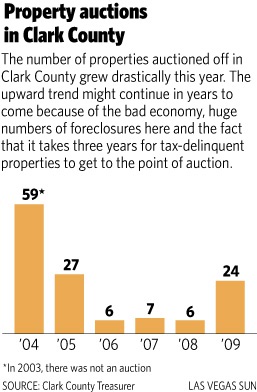

About 190 people showed up to see if they could get a bargain on any of the 24 properties — some fairly nice homes and lots — the county was auctioning because the property taxes hadn’t been paid for years.

One county observer said the large turnout might have been driven by marketing gurus who sell advice on how to make easy money amid the country’s foreclosure crisis.

“Pay off the taxes, own a home,” he said, though he doubted its wisdom.

Still, some of those who placed winning bids with the fast-talking auctioneers did appear to get incredible deals. An acre in Logandale went to a laid-off MGM bellman for about $5,000; a 1,500-square-foot Green Valley Ranch home assessed this year at $239,000 went for $131,000; a 1,400-square-footer in Henderson that was assessed at $164,591 this year sold for $75,000.

Sarah and Fred Jovellanos, who retired here three years ago from Yorba Linda, Calif., saw the auction as an opportunity to invest in something that will pay more interest than the banks.

“If we get a house for $100,000, then rent for $1,000, that’s $12,000, that’s 12 percent a year,” said Fred, 74, smiling. “What do the banks give you now? 2 percent?”

Sarah, 63, said her cutoff price was $100,000. The two left without a home but said they’d be back next year for the annual sale.

Undoubtedly, so will many more, drawn by what some envision as a growing cache of auction-worthy homes.

David Sullivan, a property analyst for Manidzhment LLC based in Fullerton, Calif., said the auction Thursday was just the “calm before the storm.”

The reason: Homes and condos don’t wind up on the auction block until the property taxes have been delinquent for three years, after notices and letters and other attempts to obtain tax payments are exhausted.

Assistant Treasurer Rebecca Coates said about 400 properties in Clark County began the past year with tax problems. To reduce that number, the county pays for title searches to find owners and sends notices and posts public notices to get payment without going to auction.

“We don’t want to have to sell these homes out from under people,” she said.

In the past, homes have come up for auction because the owners were deceased, or the owners weren’t of sound enough mind to realize they needed to pay.

Property owners who started to fall behind on their taxes in 2008 won’t see their homes and condos on the auction block until 2011.

The foreclosure crisis itself may not contribute many homes to the next several years’ auctions, however.

Richard Stewart, senior assessment analyst for the Clark County assessor, said it’s unlikely lenders will allow many foreclosed homes to get that far.

“They have a lot to lose, they have the mortgage, so they’ll keep paying the taxes,” he said.

Indeed, when Stewart checked two of the homes auctioned Thursday, lenders were not associated with either. He presumed that meant they were purchased with cash.

But Coates said lenders aren’t always on top of all their paperwork. She remembers one lender being stunned that a home it had in foreclosure was being auctioned.

“They got the notices but no one ever got back to us,” she said.

David Dudek, a California-based appraiser at the auction, noted that at a similar auction in California, 1,000 people showed up to bid on 2,000 properties. Even with less competition, it was more of a frenzy, and properties were bid up to about their market values.

So does that mean Californians have more belief than Nevadans in an upcoming economic recovery, and want to get property now so they’ll have it before another boom?

Maybe, Dudek pondered. But it might also have been a lesson in mob behavior.

“Maybe it was the hype of that many people in a room so big you could hardly see the auctioneer,” Dudek said. “A couple properties came up and 40 hands shot up bidding on one property. You didn’t see that here. Maybe people are a little more wary.”

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy