A view of MonteLago Village and the Ritz-Carlton at Lake Las Vegas, an upscale community that has been devastated by the recession.

Monday, March 1, 2010 | 2 a.m.

In Today's Sun

Timeline

Lake Las Vegas ad from 2006

An advertisement for Lake Las Vegas from 2006.

Sun Archives

- Casino MonteLago at Lake Las Vegas to close next month (2-16-2010)

- Ritz-Carlton Lake Las Vegas to close in May (2-8-2010)

- Current, past owners spar in Lake Las Vegas bankruptcy case (9-21-2009)

- Lake Las Vegas proposes bankruptcy plan (9-5-2009)

- Judge approves bankruptcy for Lake Las Vegas golf course (6-29-2009)

- Another golf course to close at struggling Lake Las Vegas (6-25-2009)

- Lenders seek control of Lake Las Vegas hotel (6-4-2009)

- Ritz-Carlton bought amid financial woes (3-24-2009)

- Residents of bankrupt Lake Las Vegas face uncertainty (3-23-2009)

- Lake Las Vegas can abandon golf course, judge says (1-15-2009)

- Resort golf course’s fate spurs debate (12-16-2008)

- Bridge over troubled water (5-24-2008)

- Casino MonteLago swaps managers (6-17-2007)

- Grand opening set for new Lake Las Vegas casino (5-7-2003)

- Ritz-Carlton Lake Las Vegas spa and golf resort opens (2-11-2003)

The pitch was right out of a travel brochure for Tuscany. Italian-style architecture, miles of greenery, wineries and sidewalk cafes, all set around a 320-acre lake.

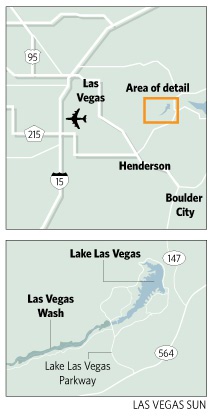

Lake Las Vegas would be a Mediterranean oasis plopped in the middle of the desert, developers promised. Nearly 20 miles and a lifestyle removed from the glitz of the Strip, the lakeside community would provide refuge for visitors and residents alike.

It was supposed to be an elegant residential hideaway, a place for cocktails on pontoon boats at sunset, top-caliber golf and dining at fine hotels free of slot machines.

Who could resist?

But with homes costing millions of dollars plummeting in value and a posh hotel saying it will lock its doors in May, residents may be questioning the wisdom of investing in a community tucked out of view 17 miles from the Strip.

“All of the news we’ve had over the last few years has been disheartening on a lot of levels,” said condo owner Sherri O’Boyle, president of her homeowners association who from 1994 to 2000 was vice president of marketing for Lake Las Vegas. She remains sold on the community: “I still believe Lake Las Vegas will be here for a very long time. The people who can hang on will do so.”

The development was conceived more than 40 years ago by actor and hotel investor J. Carlton Adair, who bought the land and the water rights to develop what he would call Lake Adair. He would never see it. Adair declared bankruptcy in 1972, a prelude of what was to come for the development.

After another failed attempt by Pacific Malibu Development Corp., the Santa Monica, Calif.-based Transcontinental Corp. acquired the land in 1990. Transcontinental owner Ron Boeddeker envisioned re-creating Italy’s Lake Como in the sewage-filled Henderson swamp.

The man-made lake would be no cheap investment, costing tens of millions of dollars to build and about $2 million a year to keep full of water from Lake Mead, two miles to the west.

It would serve as the sparkling centerpiece for Boeddeker’s resort community of luxury hotels, championship golf courses designed by Jack Nicklaus, shops and restaurants and thousands of custom homes.

The area quickly won notice. Golf Magazine named it one of the top communities to semi-retire to, and the development was named one of the 10 most important projects in the world during an international architecture and design exhibition.

Its cachet rose when Celine Dion purchased a $1.2 million home there in 2002.

But then Lake Las Vegas sprung a leak.

The property went into foreclosure after Transcontinental defaulted on $540 million in loans in fall 2007. The development was acquired by the Atalon Group in January 2008, only for it to file for Chapter 11 bankruptcy protection six months later.

The problem: Because Lake Las Vegas was heavily dependent on secondary home buyers, it was crippled when discretionary spending dried up and the booming Las Vegas real estate market crashed.

The community’s three golf courses also went into foreclosure, only one of which has since reopened. Wells Fargo took over Loews Lake Las Vegas — one of three hotels alongside the lake — in June, and in the latest in a string of bad news for Lake Las Vegas, the Ritz-Carlton announced Feb. 8 it would be closing its doors in May, and Casino MonteLago, the community’s only casino, said it would be shutting down in March.

Indeed, Lake Las Vegas, a well-heeled community striving for seclusion, has found itself completely exposed to the Great Recession.

The development still presents a pretty face, with palm trees lining the entrance and wrought-iron gates guarding hilltop mansions. And even if the greens of the foreclosed golf courses have browned, landscapers have maintained the manicured grounds, including the community green that has hosted wine-and-cheese gatherings, art festivals and concerts by the likes of Italian tenor Andrea Bocelli.

But still, the signs are there.

In 2009, banks foreclosed on 124 of Lake Las Vegas’ 1,700 homes, according to real estate research firm SalesTraq. That number compares with 15 foreclosures in 2007 and 123 in 2008.

And MonteLago Village, a collection of boutiques, galleries and restaurants, is largely empty of strollers even on sunny weekday afternoons, allowing shopkeepers to while away the time talking to friends on the phone or taking long cigarette breaks.

Marianne Freeman, who owns Tesoro, a home furnishings and accessories store, blames the slowdown in the village on the bankruptcy buzz.

“When the news of the bankruptcy information hit last year, the perception by the local clients was that Lake Las Vegas is closed,” she said. “People stopped coming out.”

Some residents shrug off the depressing scene.

“I don’t think what’s going on in our community is any different from what is going on in the rest of Las Vegas,” SouthShore Homeowners Association President Vicki Hafen Scott said.

Her custom-home neighborhood is one of 19 in Lake Las Vegas, where home prices range from $365,000 to $3.3 million, according to SalesTraq.

During 2005-06, 10 custom homes were selling a month, SalesTraq President Larry Murphy said.

In 2009, custom-home sales slowed to fewer than one a month.

Home Builders Research President Dennis Smith said the difference between Lake Las Vegas and Summerlin, whose developer is also in bankruptcy, is Summerlin’s varied offerings.

“Historically, Lake Las Vegas has targeted one small segment of the spectrum and that is your luxury buyer or investor. When the market went bad and you don’t have that diversity, it’s going to affect you more,” Smith said.

Resales rebounded somewhat in 2009, accounting for two-thirds of the 435 units sold from 2007 to 2009, according to SalesTraq. But 208 of the homes sold in 2009 were bank-owned, diminishing the price of some of the high-end homes.

Indeed, the average square-foot price of a resale home dropped from $544 in August 2007 to $106 in November, according to SalesTraq.

Holly and Sol Malka jumped on one of the foreclosed homes, benefiting from the recession when moving here from Birmingham, Ala.

“Lake Las Vegas’ financial situation did affect our decision, but not in a negative way. Las Vegas is a very attractive place for someone looking for a deal right now,” Holly Malka said. “We firmly believe that Las Vegas is going to come back, and we’re probably going to see some increase in our home value as well.”

But the closing of the Ritz-Carlton won’t help homeowners, analysts say; an empty hotel adds to the bad perception of an already troubled development.

“The hotel is closed. The golf courses are closed. What are the owners getting for their HOA dues? I’m sure a lot of homeowners have to question what are my dues going to if the amenities aren’t there,” Smith said.

The AAA Five Diamond Ritz-Carlton, known for its man-made white sand beach and pricey spa treatments, has been a fixture at Lake Las Vegas since it opened in February 2003 — and has languished in financial trouble since. The former owners, Village Hotel Investors LLC, filed for Chapter 11 bankruptcy in April 2008 to stop foreclosure of the $103 million mortgage. It was purchased by Village Hospitality LLC, an arm of Deutsche Bank, a year ago.

Village Hospitality has not indicated its plans for the facility after it closes.

CB Richard Ellis Executive Vice President John Knott estimates the Ritz-Carlton is worth about $30 million but said Deutsche Bank could be looking for offers up to $80 million.

Ritz-Carlton spokeswoman Vivian Deuschl said like most other sister properties in the United States, the bulk of the Lake Las Vegas hotel’s business comes from meetings, one of the reasons the property suffered so much when Las Vegas’ meeting and convention business declined.

Business owners and homeowners aren’t so sure that the loss of the Ritz-Carlton will hurt them.

“Certainly the closure will affect my business to some extent, because the Ritz has always brought in visitors from across the county, but it won’t have a huge impact,” Freeman said.

“At first, you’re like ‘Oh my God. The Ritz is closing,’” Holly Malka said. “But I don’t go to the Ritz. I live here.”

But the resort’s closing spooked Casino MonteLago owners, who have decided to close their casino as well. Between that and the hotel closing, 177 jobs will be lost.

But for all the effects of the Great Recession at Lake Las Vegas, there is this optimism:

The Nevada Transportation Department has begun a $13 million widening project on Lake Mead Parkway to accommodate anticipated increases in traffic to the development.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy