Despite little change in company fundamentals, stock prices of Las Vegas gaming companies have risen in recent months. Clockwise from top left: Wynn Las Vegas, MGM Grand, Boyd Gaming-owned Orleans Hotel-Casino and the Las Vegas Sands-owned Venetian.

Monday, Sept. 21, 2009 | 2 a.m.

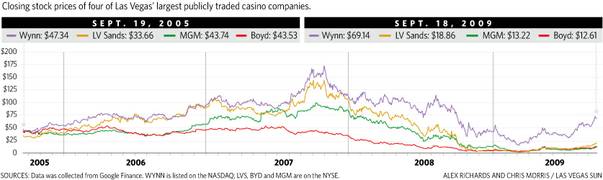

Las Vegas casino stocks had steadily declined for months by the time Lehman Bros. filed for bankruptcy and Bank of America swallowed Merrill Lynch a year ago. Darker days were yet to come as earnings fell in the fourth quarter of 2008 and again in early March when, as Chapter 11 bankruptcy loomed for Strip bellwether MGM Mirage, three of the four major casino stocks in Las Vegas traded below $4 per share.

Sun Coverage

These onetime darlings of Wall Street had become among the most shunned sectors of the American economy as boom-era spending and debt became unsustainable and business plummeted.

So consider this: Despite little good news coming out of Las Vegas and no sign of an imminent turnaround, three of the four major Las Vegas casino stocks have more than doubled in value over the past three months.

Shares of Boyd Gaming are up nearly 30 percent from three months ago, while the stocks of MGM Mirage and Wynn Resorts are up more than 100 percent. Shares of Las Vegas Sands — up nearly 150 percent over this period — have risen the most after falling harder in the downturn.

This, despite that Wall Street analysts lowered 2010 profit estimates for these companies early this year and late last year. (Estimates for MGM Mirage swung from a profit to a loss in March.) Estimates for Wynn and Sands have inched up more recently but are still depressed compared with 2010 estimates from last fall, before the biggest earnings declines.

“There’s nothing going on fundamentally, in the near term, to get enthusiastic about unless you think the economy has turned and we’ll see more domestic and international travel (to Las Vegas), and I’m somewhat skeptical on all those,” said Dennis Forst, a stock analyst with KeyBanc Capital Markets.

So what’s to love?

Some of the rebound is tied to the fact that MGM Mirage and Las Vegas Sands — among the most leveraged of the casino companies — have escaped bankruptcy in the near term. Like many American companies, they have injected new equity and borrowed more, giving them more time to ride out the economic storm. The capital markets have opened somewhat since the market crash, giving companies the ability to raise needed cash.

“These companies’ balance sheets are in much better shape,” Forst said.

Over the past few months, MGM Mirage has been the busiest of the big publicly traded companies in reducing its debt load. The company has sold more than $2 billion in stock and bonds and continues to refinance debt to slash billions in debt coming due in the next few years. The company has a long way to go yet to that point, analysts say.

In a note to investors last week, stock analyst Robert LaFleur of Susquehanna Financial Group said investors “appear willing to overlook still-lackluster fundamentals and valuation levels that we have only seen in the 2006-2007 bubble years.” LaFleur thinks MGM Mirage is too expensive at $12 per share and that the company — though surviving the downturn — may not return to pre-recession earnings levels until 2015.

While hotel executives are hoping for a boost when MGM opens its CityCenter development late this year, some analysts are concerned the $8.5 billion resort complex will hurt business elsewhere on the Strip, including the company’s own casinos. LaFleur has lowered 2010 earnings expectations for MGM Mirage from $1.9 billion to $1.4 billion.

Much of the rise in Wynn and Sands stocks, which have increased the most in recent months, is driven by news from Macau, the Chinese enclave halfway around the world from Las Vegas where these companies generate most of their earnings. Earnings have improved there, in part because of improved high roller business, even though the Chinese government has restricted travel to Macau from its chief feeder market, mainland China. Both companies’ shares also have traded up on news that they will raise money in Hong Kong-based initial public offerings of their Macau assets.

Macau is less of a factor for MGM Mirage, where more than 80 percent of earnings are generated on the Las Vegas Strip.

Some investors have been banking on a strong long-term recovery for Las Vegas at a time when analysts who didn’t react fast enough to the downturn are gun-shy about calling a rebound.

Some of this increase has little to do with Las Vegas, however. Investment managers who pulled money out of the market during its free fall are now putting money back in, and some are focusing on sectors, such as gaming, that were the most battered in the economy.

“This is uncharted territory for everybody,” LaFleur said. “Things that might not have made sense before seem to make sense now, and one of those sentiments is that not getting worse is the new better.”

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy