Part of the La Madre Mountains looks down over the sprawling housing growth of Summerlin.

Wednesday, Aug. 12, 2009 | 2:05 a.m.

Related stories

- Howard Hughes’ heirs fight for control over Summerlin property (7-17-2009)

- Developer’s bankruptcy reorganization may affect area shopping malls, gas pipeline (7-17-2009)

- Mail operator remains upbeat (5-29-2009)

- General Growth Properties reports quarterly loss (5-7-2009)

- General Growth files for Chapter 11 protection (4-24-2009)

- General Growth files for bankruptcy; malls likely to stay open (4-15-2009)

- General Growth stock up on news report (3-31-2009)

- General Growth extends forbearance request (3-16-2009)

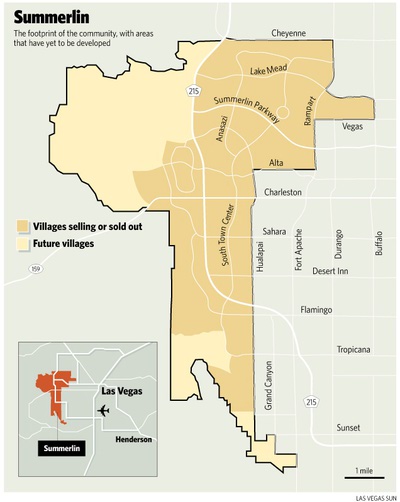

Summerlin developer General Growth Properties Inc. is disputing assertions by the heirs of Howard Hughes that their Las Vegas assets have been improperly tied up in the bankruptcy of General Growth.

Since selling their Summerlin land holdings in 1996 to the Rouse Co. — now owned by General Growth — the Hughes heirs have been receiving periodic payments in the form of stock from General Growth as Summerlin has been developed.

Because of uncertainties about the future value of the Las Vegas land, the 1996 deal was structured with an initial payment followed by periodic payments thereafter so the Hughes heirs could share in the profits as Summerlin grew.

A final stock payment is coming due and is to be based on an appraisal this year of the remaining developable land, about 7,381 acres.

But the April bankruptcy of General Growth — best known as a shopping mall owner — has created uncertainties about the final payment due the Hughes heirs. General Growth insists the deal with the heirs can be canceled by the bankruptcy court, though General Growth has not asked for such a cancellation.

The Hughes heirs are now agitating in the bankruptcy process, complaining the Summerlin land they have an interest in has been improperly encumbered by liens that General Growth agreed to give lenders for financing of up to $625 million in loans before and after the bankruptcy filing.

The Bankruptcy Court rejected the heirs’ initial objections to the financing deal, so a group of heirs filed an appeal in U.S. District Court in New York.

“The debtor in possession financing does not provide any benefit to the Summerlin debtors or the Summerlin property, but rather benefits other insolvent and solvent debtors,” a group of heirs, working together as A&K Endowment Inc., said in a court filing last month. “The final debtor in possession order has further resulted in a lien upon the property held by the Summerlin debtors, in violation of, among other things, certain fiduciary and contractual obligations under both common law” and the 1996 land sales agreement.

The heirs said General Growth’s master planned community business, including Summerlin, “is, in many ways, little more than a side business generating auxiliary revenue at little additional expense.”

“There is little to do with respect to the master planned communities besides sell the property to homebuilders and commercial developers,” the heirs said in arguing that the Summerlin land should not have been encumbered by liens for the loan benefiting other General Growth businesses.

But Chicago-based General Growth and the bankruptcy case’s Committee of Unsecured Creditors disputed those arguments in court papers filed Monday.

“The debtor in possession loan benefits all debtors by providing adequate liquidity to assure that the debtors can continue to provide integrated leasing, management and operating services to their shopping center properties, pay employees, satisfy post (bankruptcy)-petition obligations, and pay the administrative costs of these Chapter 11 cases and, most importantly for purposes of this appeal, continue operations of the Summerlin planned community to preserve and enhance its value for all constituents,” General Growth argued.

The company denied that it has violated the terms of the Hughes’ heirs land sales to Rouse, called the Contingent Stock Agreement (CSA).

“Appellant only holds a contingent right to stock pursuant to the CSA, and does not hold or assert any direct interest in Summerlin that would give rise to any basis to object to imposition of a lien on the property,” General Growth’s brief said. “Indeed, whether or not a lien is attached to Summerlin pursuant to the final debtor in possession (financing) order, appellant’s interests in the contingent stock remain the same. Nothing in the record provides a basis for the conclusion that the final debtor in possession order impairs appellant’s rights under the CSA.”

The New York federal court has ordered the parties to submit any final briefs in the dispute by Aug. 24, after which oral arguments may be scheduled.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy