Wednesday, Oct. 22, 2014 | 2 a.m.

When the Las Vegas Metro Chamber of Commerce cuts a check to a candidate running for political office, Nevada law caps its contribution at a maximum of $10,000.

But if the chamber wants to donate money to influence a ballot question — such as this year’s margin tax initiative — state law sets no limit on how much it can give. So far the group has given $1.1 million to oppose the margin tax, about 25 percent of the campaign's total.

This inconsistency in state law has left the door open for major businesses, unions and trade associations to funnel unlimited amounts of money to groups supporting or opposing the margin tax.

This isn’t what voters intended. A constitutional amendment approved in 1996 called for campaign finance reforms that included caps on contributions to ballot question advocacy groups.

But the wording was never put into state statute, setting the stage for this year’s big-spending showdown about whether to raise taxes to support public education.

The backstory

In 1996, voters by a 2-to-1 margin approved a constitutional amendment calling for limits on campaign contributions. The state previously had no cap on how much an individual or a corporation could give to candidates for political office.

Under the amendment approved by the voters, contained in Article 2, Section 10 of the state constitution, contributions to individual candidates are capped at $10,000 — $5,000 for the primary election and $5,000 for the general election. The Legislature adopted the limits into state statute in 1997, and they remain in place today.

The amendment also called for a $5,000 limit on contributions to ballot question campaigns.

But when the Legislature met in 1997 to add that language to state law, attorneys from the state Legislative Counsel Bureau warned the limit was likely unconstitutional and could leave the state vulnerable to a lawsuit.

The reason: The U.S. Supreme Court found that a similar limit on ballot question campaigns in California violated free speech rights in the First Amendment.

Nevada lawmakers left the ballot question cap out of the law and haven't seriously considered the issue since.

What that means today

After years of fighting about public education reforms, the state teachers union took the issue straight to the voters with a ballot question.

The proposal on the Nov. 4 ballot, Question No. 3, calls for a 2 percent tax on revenues for businesses that make more than $1 million per year.

Supporters say the tax will deliver more money to Nevada’s underperforming public schools. Opponents say the tax will hurt businesses with higher costs and lost jobs.

The two sides have spent big money through cash and in-kind contributions to get their message out.

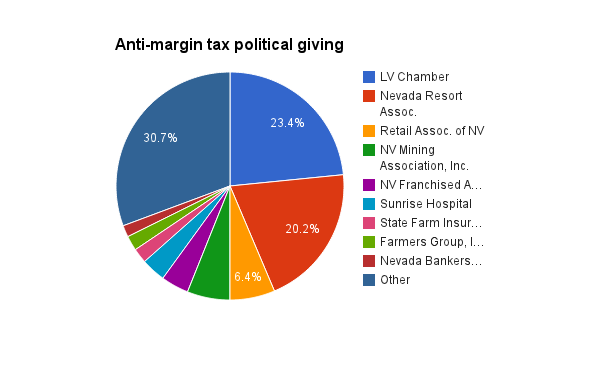

The Coalition to Defeat the Margin Tax Initiative has raised $4.7 million from major players in the state’s gaming, business, mining, banking and insurance industries. That includes 72 contributions of more than $10,000, the limit that applies to candidate contributions.

The Nevada Resort Association has given contributions of $391,000 and $250,000 through its political action committee. The Las Vegas Metro Chamber of Commerce and its affiliates have given five separate contributions of at least $100,000.

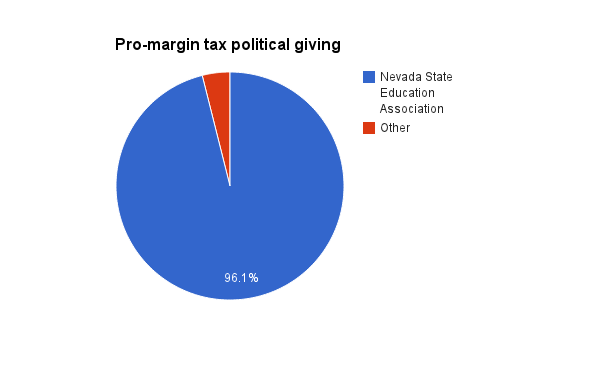

The pro-margin tax group, the Education Initiative, has raised $2.6 million, with 96 percent coming from the Nevada State Education Association, the state teachers union.

Assemblyman James Ohrenschall, who chairs the Legislative Operations and Elections committee, said he thinks the discrepancy between candidate and ballot question contributions in the law is worth debating.

“I’m sure advocates of the status quo will argue it’s a free speech, First Amendment issue, but there are caps on candidates,” he said. “To have one group or have one wealthy person be able to bankroll an entire initiative, that does seem like you have two separate systems.”

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy