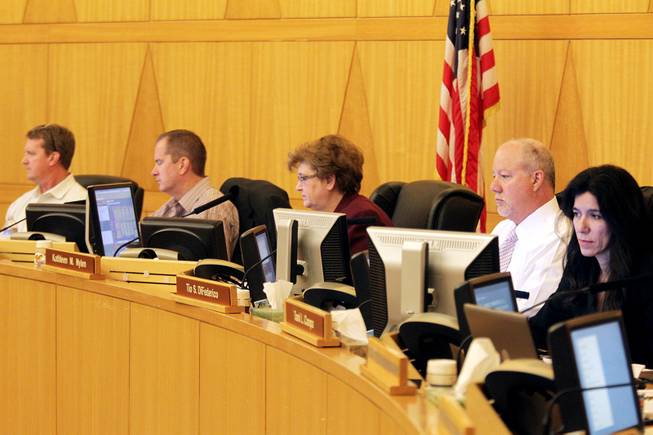

The Board of Equalization meeting at the Clark County Commission Chambers in Las Vegas on Friday, February 22, 2013.

Thursday, Feb. 28, 2013 | 2 a.m.

It’s 8 a.m. on a recent Saturday at the Clark County Commission chambers as five members of the Board of Equalization take the dais, coffee cups in hand.

The chamber seats are filled with homeowners from throughout the valley. Some are angry, many are confused and others are just plain tired, but they all share a common cause — they think the assessed value of their house is too high.

The first case is called — a three-bedroom, 7,636-square-foot Green Valley Ranch home valued at $1.65 million — and the hearing is under way.

Over the next five hours, the board will work its way through a 30-page agenda, calling on more than 50 homeowners individually to make their arguments about why the county assessor’s office overvalued their house.

The Green Valley homeowner, bearing a recent appraisal valuing the property at $1.1 million, is successful and her assessed value is reduced to $1.3 million, but victories would be hard to come by that day.

It’s a David vs. Goliath-type situation as homeowners, often with little to no real estate background, present before a board made up of certified appraisers with 100-plus years of combined experience. Three of four cases fail and the county’s assessed value is upheld, but for the few with the right list of comparable home prices or a recent home appraisal, the board can lower their assessed value and potentially save them some money on their property tax bill.

“The people that appeal it the majority of the time wish they had a case,” board member R. Scott Dugan said. “Some of them do. We help people when we can, but sometimes we can’t because people are unrealistic.”

With about 730,000 parcels in the county, errors in assessed values crop up because the county’s assessors office appraises “like properties” in groups of 50 to help save time.

By law, assessed values are supposed to be equitable to similar properties in an area and must not exceed the full market value of the property.

Assessed values have an impact on property taxes paid by the owner, even though those property tax increases are capped at 3 percent per year, stymieing the impact of large jumps in property value.

“We’re pretty solid, but there are things that come to light that we’re not aware of. We do make mistakes and we really want to correct those when they’re brought to our attention,” said Rocky Steele, assistant director of assessment services for the county assessor.

The Board of Equalization will hear more than 5,600 appeals between February and the beginning of March. With so many cases, the board has met three times a week, including Saturdays, for the past month, with meetings often lasting more than five hours. Many property owners fail to show up for their scheduled hearing, resulting in a default judgment against them.

The number of appeals has dropped significantly in the past few years after reaching a high of 10,658 cases in 2011 due to turmoil in the housing market.

To help lighten the workload, the board, which has five members and five alternates, hears commercial and residential property appeals on different days, swapping out board members based on their availabilities and expertise.

Board members are paid $125 per day, a fraction of what they make doing private work, and many say they serve out of a sense of public duty.

“I look at it as community service, giving back to the community in a way that uses my skills,” said board member Kathleen Nylen, a principal at PBTK Consulting.

Dugan, who has been on the board since 1993, has been appraising homes in the valley for 40 years and owns his own appraisal company.

With so many cases to get through, he has little patience for homeowners who aren’t prepared and he’s unafraid to raise his voice with stubborn homeowners.

“There’s always those people who think they’re right and the rest of the world is wrong,” Dugan said. “I try to calm them down and make sense and rationalize with them to a degree, but sometimes we just can’t.”

Those who disagree with the board’s rulings can appeal to the state Board of Equalization.

After arriving at 7:15 a.m. and nervously waiting as the board rejected appeal after appeal, homeowner Laurie Howard-Malm finally got her chance to argue her home’s value around noon Saturday.

A 2,800-square-foot home near Warm Springs Road and Decatur Boulevard, Howard-Malm’s property initially was assessed at a value of $502,000 by the county.

“I came here last year but didn’t go before the board because I was so overwhelmed and I didn’t have the statistics I needed,” she said. “It’s worse than the DMV.”

This year, armed with a list of comparable properties in her neighborhood and information about a nearby railroad that rattles the windows of her home when trains pass, Howard-Malm argued the home was worth about $300,000. Board members agreed the home wasn’t worth what the county said, lowering its assessed value to $350,000.

“I would have liked it to go down more, but I can see why they weren’t going to do that,” she said. “My husband and I are trying to get to the point where we can retire completely, and property taxes make a difference on a limited income.”

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy