Published Wednesday, Oct. 10, 2012 | 7:25 p.m.

Updated Thursday, Oct. 11, 2012 | 9:21 a.m.

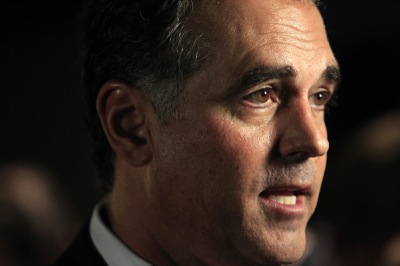

The Federal Deposit Insurance Corp. made a move Wednesday to start seizing Nevada assets from congressional candidate Danny Tarkanian and members of his family toward a $17 million judgment, apparently put in motion because, lawyers argue, Tarkanian missed a key deadline to file an objection.

In a court filing first reported by political journalist Jon Ralston, lawyers for the FDIC stated that the Tarkanian family’s lawyers had missed a mutually agreed upon Oct. 8 deadline to file documents opposing the FDIC’s claim to his property in Nevada.

Not filing any objection on time counts as a forfeit, the FDIC argued, clearing the way for them to start seizing Tarkanians’ property after the next scheduled court hearing on Oct. 22.

“Local Rule 7.1.e.2 requires a party opposing a motion to file an opposition by the due date,” FDIC lawyers wrote in the filing. “In light of Defendants’ failure to timely file an opposition to the instant motion or timely request an extension of time, FDIC-R’s motion should be granted as unopposed.”

But in an interview with the Las Vegas Sun Thursday morning, Danny Tarkanian said there was a good reason for his lawyer having missed the filing date, and didn’t expect it would affect the outcome of the case at all.

“My attorney missed it because his father passed away,” Tarkanian said. “There’s things that go on behind the scenes that affect things...things that happen personally. That’s where we’re at and that’s what we have to deal with.”

“This is a procedural matter, it has nothing to do with the merits of our case and whether we win or lose at the end,” Tarkanian added. “That’s going to be at the court of appeals...So it’s a non-story.”

Tarkanian explained that his family is starting court-mandated settlement talks on the matter that started when his family put up land in Henderson as collateral for an investment in a California real estate venture. The deal went south when the bank behind the deal failed in the economic crisis. The government foreclosed on the Tarkanian’s collateral property, but didn’t collect nearly the amount the Tarkanian’s had valued it at when they entered the California land deal at the height of the market in 2007. Because the FDIC only guarantees up to $250,000 in assets when banks fail, they started coming after the Tarkanians for the rest -- and in May, a federal judge gave the FDIC carte blanche to do so.

But the Tarkanians -- or Danny Tarkanian, at least -- do not seem at all ready to concede to the FDIC because they are starting to play hardball in the Nevada courts.

“Even if they do come in and start going after our assets, that’s what happens, that’s normal, it’s not going to affect us or force us into bankruptcy,” Tarkanian said.

And certainly, Tarkanian stressed, it will not change anything before Election Day. Tarkanian is the Republican candidate running to represent Nevada’s new 4th congressional district.

“There’s nothing that’s going to happen before the election...There’s no chance of filing bankruptcy before this election and until we get this matter resolved,” Tarkanian said, estimating that resolution of the FDIC matter “is going to be weeks away if not a month or two away.”

Tarkanian also wanted to make it clear that the danger of filing bankruptcy was more of a concern to other members of his family named in the suit than himself.

“If a bond is required it could force some members [of my family] to file bankruptcy,” Tarkanian said. “But some members are not all members and they are different than me personally.”

But when asked to clarify if there was any chance of him potentially filing bankruptcy as a sitting congressman, he demurred.

“What may happen or not happen is hard to determine,” he said. “But I’m not concerned about it.”

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy