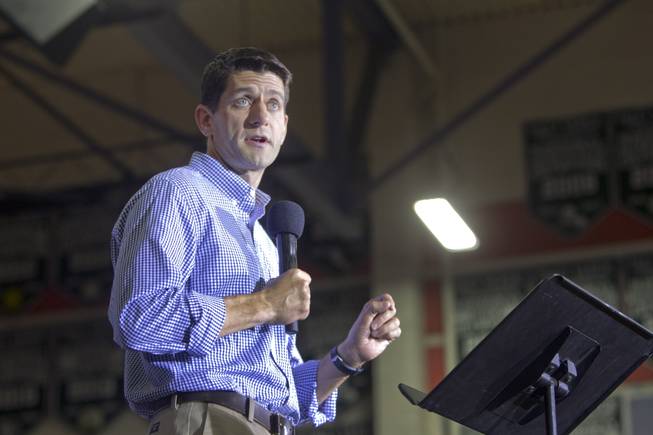

Republican vice presidential candidate Paul Ryan addresses a rally at Palo Verde High School in Summerlin on Tuesday, Aug. 14, 2012.

Sunday, Aug. 19, 2012 | 2 a.m.

Rep. Paul Ryan’s proposed federal budget — now starring as the centerpiece of the presidential campaign as he joins the Republican ticket — would reshape American government, achieving long-sought conservative goals and reversing an 80-year path of larger, more expensive federal programs.

Under Ryan’s plan, which has passed the Republican-controlled House twice in slightly different versions, the Internal Revenue Service would tax the wealthiest Americans less but many of the poorest ones more; Medicare would be transformed; Medicaid would be cut by about a third; and all functions of government other than those health programs, Social Security and the military would shrink to levels not seen since the 1930s.

Mitt Romney has made a point of saying that he’s running on his own budget, not Ryan’s, but even before choosing him as a running mate, he had adopted much of Ryan’s plan. Romney’s tax plan would reduce tax rates by less but closely resembles Ryan’s, and so do his plans for Medicare, Medicaid and other safety-net programs.

The Ryan plan would not balance the federal budget for another 28 years at least, according to an analysis by the nonpartisan Congressional Budget Office. That means the federal debt would continue to rise. That’s partly because the tax cuts take effect right away while the Medicare cuts kick in later, as people now age 55 hit retirement. It’s also partly because Ryan’s proposed tax cuts considerably outweigh even his ambitious spending reductions.

Ryan concedes that his plan would not balance the budget this decade, predicting it could be balanced by the “mid- to early 2020s” because his plan would ignite rapid economic growth. Like his onetime mentor, Jack Kemp, the 1996 Republican vice presidential nominee, Ryan argues that the key to economic growth is not balancing the budget but lowering tax rates.

“Growth is the key to fiscal sustainability, and low rates are the key to growth,” he said.

But even if low tax rates spur the economy — a debatable point among economists — a balanced budget will depend on wiping enough tax breaks off the books to offset the new tax cuts.

In the more than two years since his budget was unveiled, Ryan has not specified any tax breaks he would eliminate. Independent analyses have shown that offsetting the tax cuts would require changing things such as the mortgage interest deduction, the tax exclusion for employer-financed health insurance or other popular tax preferences widely used by middle-income households.

For any of these changes to take place, of course, Romney and Ryan would have to win the election and probably carry a Republican Senate with them.

Republicans hope the Ryan budget will propel their campaign forward, grabbing the mantle of “change” away from President Barack Obama. Democrats fervently believe Ryan’s plan will become a major weapon for their side.

Medicare

Ryan would shift Medicare from a system in which everyone gets the same set of benefits, paid for by tax funds, to one in which the government would give each senior citizen a fixed amount of money.

When people now age 55 or younger reach retirement, they would be given the option of using that “premium-support” payment, or voucher, to buy private insurance policies or enroll in Medicare.

The amount of the payment would vary from one region of the country to another, depending on the cost of private insurance plans. In some places, at least in the early years, the premium-support payment might cover the full cost of Medicare, but there’s no guarantee of that.

Ryan also would lift the Medicare eligibility age from 65 to 67 by 2034.

Supporters say the premium-support approach would hold down the federal government’s spending on health care because seniors would have an incentive to shop for the cheapest plans, and competition among private health plans would push costs down. But critics argue that elderly sick people aren’t likely to be good comparison shoppers and could easily be misled by complicated insurance programs.

Detractors also say health insurers would have a huge incentive to create low-cost plans for younger, healthier seniors, leaving Medicare with the oldest, sickest patients and driving up its costs.

Medicare beneficiaries have average incomes of $20,000 a year. Last year, the federal government spent $5,500 for each beneficiary, according to the Congressional Budget Office, which projects that cost will rise to between $8,600 and $9,600 by 2030. Ryan would cap the spending at $7,400 per senior. So, unless costs grow much more slowly than expected, the average retiree on Medicare would have to pay between $1,200 and $2,400 a year. The amount would rise over time and would probably be higher for those with chronic health problems.

Taxes

Ryan’s plan would keep the tax cuts enacted under President George W. Bush and add $4.5 trillion in cuts over the next decade. It would do that by replacing the six current tax rates with two — 10 percent and 25 percent. It also would eliminate the Alternative Minimum Tax and cut corporate taxes.

Not all Americans would get a tax cut, however. The plan would repeal tax breaks for low-income families with children and other changes adopted in 2009 under Obama. The net result would be a tax increase for the bottom fifth of households and a big tax cut at the top, according to the Tax Policy Center, a nonpartisan Washington think tank.

In many cases, low-income households would see a tax increase of $100 or less, but some would be hit harder. Among households earning between $10,000 and $20,000 a year, about 1 in 5 would get a tax increase averaging over $1,000, the Tax Policy Center analysis showed. Households earning more than $1 million a year would get nearly 40 percent of the benefits of the plan, with a cut averaging about $265,000. Ryan has not challenged those figures.

Those tax cuts would reduce overall federal revenue far below the level of spending that Ryan would allow. The result would be a very large deficit — larger than Obama envisions. To keep that from happening, Ryan says he would eliminate existing tax breaks to “broaden the base” of the tax code.

“What we’re saying is take away the tax shelters that are uniquely enjoyed by people in the top tax brackets so they can’t shelter as much money from taxation,” Ryan said in a CBS “60 Minutes” interview last week.

While upper-income taxpayers pay a lot of taxes, many of the tax benefits they use are either supported by Ryan and Romney or don’t come close to closing the gap.

One of the largest benefits for upper-income taxpayers, for example, is the lower tax rate for capital gains. Ryan, like Romney, opposes raising the capital gains tax rate. Indeed, in 2010, when Ryan unveiled his plan, it called for entirely eliminating taxes on capital gains, interest and dividends. Romney opposed that idea during the Republican primaries. Ryan has never disowned it but did not address the topic in this year’s version of the plan.

The remaining big tax preferences all have huge political support — the mortgage interest deduction, the exclusion of employer-provided health insurance from income, the charitable contribution deduction. Changing those would increase taxes on middle-income households, which Romney has said he won’t do. Not changing them while still enacting the tax cuts would mean a much higher deficit and rising debt.

Defense and domestic spending

One important display of priorities in Ryan’s budget is the trade-off between defense spending and domestic programs other than Social Security, Medicare and Medicaid.

Last summer, Congress and the White House reached a deal that would trigger automatic across-the-board spending cuts of nearly $1 trillion over 10 years, beginning Jan. 2 — half from defense, half from domestic programs. The automatic cuts would be stopped if Congress reaches a plan to reduce the deficit.

Ryan would upend that deal. Instead of cutting defense by half a trillion dollars over the next 10 years — which Obama also opposes — Ryan would increase the military budget by $300 billion.

Ryan would keep in place the across-the-board cuts on the domestic side and deepen them by $700 billion more.

Some of the domestic spending cuts are spelled out in Ryan’s blueprint — a cut in food stamps, for example, that would impose new limits on the length of time recipients can receive aid.

Like Medicaid, the food stamp program would become grants to the states, giving local jurisdictions more say in how the money is spent. Pell Grants for college students similarly would be capped, with new requirements that make only lower-income students eligible. Worker training programs also would be reduced.

Overall, the Congressional Budget Office said in its analysis that under Ryan’s budget, spending on defense and all domestic programs other than Social Security, Medicare and Medicaid would fall to 6 percent of the total economy by 2030, about half the current level. That would mean a smaller share of the economy going to federal domestic spending other than entitlements than at any time since the New Deal.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy