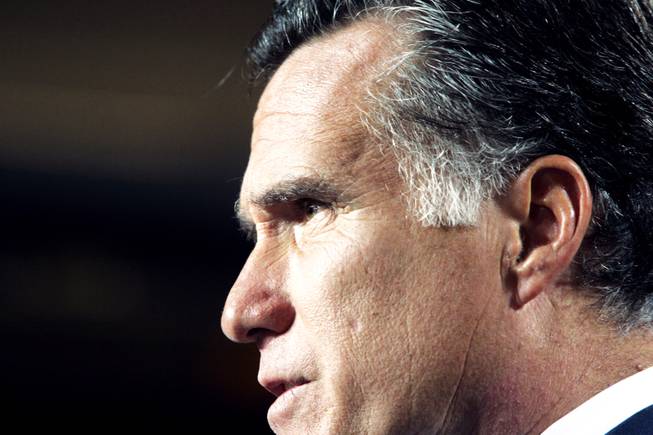

Republican presidential candidate Mitt Romney speaks at McCandless International Trucks in North Las Vegas Tuesday, September 6, 2011.

Thursday, Sept. 8, 2011 | 2 a.m.

Sun archives

Related stories

Listening to Mitt Romney detail his economic plan in North Las Vegas on Tuesday, I was reminded of the Talking Heads lyric “same as it ever was” from the song “Once in a Lifetime,” released in 1980.

Same as it ever was, because no matter the condition of the country, the Republican economic plan is always the same. For them, it’s always 1980.

We had some weird tax laws then — including in some cases rates that were too high — that stifled investment and entrepreneurship. We also suffered from high inflation. Taken together, it was called “stagflation.”

The response of President Ronald Reagan was to cut taxes, while the Federal Reserve tightened the money supply, which finally curbed inflation. The result, assisted by falling oil prices, was recovery, although it wasn’t broadly shared, as most of the gains went to upper-income Americans.

But stagflation isn’t what we face today.

“The fundamental problem in today’s economy is that there’s not enough demand,” says David Madland, an economist at the liberal Center for American Progress. In fact, our corporations are sitting on mountains of cash and corporate profits are near record levels, but they’re not hiring because they have no confidence that customers — you and me — feel economically secure enough to make purchases.

This is not some wild-eyed liberal theory. Conservative economists say it too.

“Businesses have responded negatively to the weakness of household demand,” Martin Feldstein, a former chairman of Reagan’s Council of Economic Advisers, recently wrote.

In other words, companies have the money to hire but aren’t going to because they see consumers who are out of work or nervously hoarding instead of spending.

So what does Romney propose? A cut in the corporate tax rate, naturally. He says that American corporate tax rates are the second highest in the developed world, behind Japan.

This is only true in the narrowest sense, as our corporations take advantage of huge loopholes that make their effective rates only slightly above average among industrialized countries and, according to a study released in 2008, often pay nothing at all. The most obvious recent example is General Electric, which made $5.1 billion profit on its U.S. operations in 2010, and expects to have tax liability near zero. Is GE not hiring because its tax bill is too high?

Moreover, this plan to cut taxes, in addition to other tax cuts for the wealthy and an investment tax cut for the middle class, is all the proof you need that Republicans don’t actually care about deficits. As former Vice President Dick Cheney once reportedly said, “Reagan proved deficits don’t matter.”

Both Reagan and President George W. Bush ran up huge deficits during economic recoveries. And despite all the hue and cry among Republicans about deficits, I’d bet big money they stop caring once they win the White House, and this Romney plan is a perfect illustration. He would pay for his big corporate tax cut with a 5 percent cut in nondefense, nonentitlement spending, meaning no cuts to Medicare or Social Security or the Pentagon.

Sorry, but those items make up the vast majority of the budget, so a 5 percent cut just doesn’t get you there.

Romney would also slash regulations. Fewer regulations would make it easier to start and expand businesses.

But our frenzy of deregulation since 1980 in the financial sector led to our current demise. We didn’t oversee mortgage lenders as they gave out bad loans to people who couldn’t repay. We didn’t regulate ratings agencies that gave AAA ratings to the junk. We allowed huge banks to borrow lots of money to bet on those mortgages in what amounted to a giant unregulated casino. Even we here in Nevada know the casino has to be closely monitored.

Romney concedes the need for “greater transparency for interbank relationships, enhanced capital requirements, and provisions to address new forms of complex financial transactions,” while at the same time saying he’d throw out the financial regulatory law that passed in 2010.

And who would write the new Romney regulations? Am I being cynical when I suspect bank lobbyists would write them?

Conspicuously absent from the Romney plan is anything about housing. Construction spending has led us out of just about every recession since World War II. But because there was so much overbuilding — especially in Las Vegas — construction is dormant. And because nationally there are 4 million mortgages seriously delinquent or in foreclosure, construction will remain flat for years. Romney has nothing to say about this. Maybe because it wasn’t a problem in 1980.

As Robert Reich noted in The New York Times this week, since 1980, American productivity has increased 80 percent, while average hourly compensation has increased just 8 percent. Incomes of the top 20 percent of workers rose 55 percent, while everyone else lagged far behind, and the poorest actually got poorer. In 2007, the richest 1 percent of Americans won 23.5 percent of the national income, the greatest share since 1928.

By contrast, from 1947 to 1979, productivity increased 119 percent and average hourly compensation increased 100 percent, with the prosperity shared broadly among all income groups.

What have we done since 1980? We’ve enacted a bunch of policies that Romney thinks we should enact more of.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy