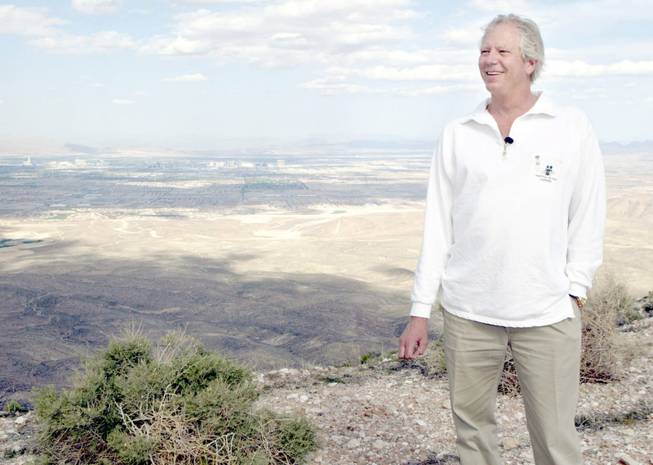

Developer Jim Rhodes smiles on Blue Diamond Hill on Monday, May 5, 2003. Las Vegas can be seen in the background.

Monday, Feb. 7, 2011 | 2:01 p.m.

Sun Coverage

The Federal Deposit Insurance Corp. is suing Las Vegas developer Jim Rhodes to enforce a personal guarantee for a soured real estate loan.

The FDIC, receiver for the failed Community Bank of Nevada, sued Rhodes last week in Clark County District Court.

The dispute arose in April 2009 outside of the bankruptcy of Rhodes' home-building empire when Community Bank sued Rhodes before Community Bank failed.

The bank lawsuit at the time charged defaults under a $2.65 million loan made in December 2005 to a Rhodes company called Tropicana Durango Ltd.

Last week's lawsuit says the April 2009 lawsuit had been settled, with the loan modified and extended.

But, attorneys for the FDIC allege, the loan again went into default and the FDIC foreclosed on the land backing the loan -- with the FDIC buying it at auction for $750,000 in February of this year.

More than $2 million was owed on the loan when the collateral was foreclosed on and Rhodes is liable for the deficiency -- but hasn't paid the FDIC for the deficiency, the new lawsuit charges.

The suit charges breach of contract, unjust enrichment and other counts.

"Plaintiff funded the loan for the benefit of defendant James Rhodes with the legitimate expectation that defendant James Rhodes would repay the loan," charges the suit, which seeks unspecified damages.

A request for comment was placed with Rhodes' office.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy