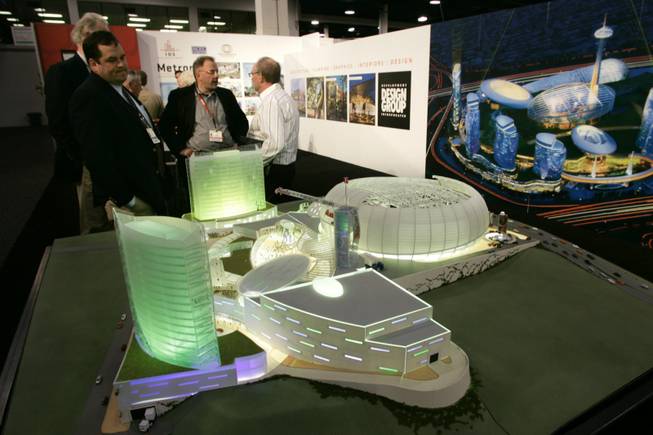

A model of Development Design Group’s Ulker Arena complex in Istanbul at the International Council of Shopping Centers convention.

Friday, May 28, 2010 | 3 a.m.

Robert Reich, shown in 2004, served as labor secretary from 1993 to 1997.

The economic recovery remains weak, Americans’ consumer spending will be tepid for a while because of stagnant wages and Las Vegas will have to rely more on foreign visitors to bolster tourism, former Labor Secretary Robert Reich said.

One of the featured speakers May 24 during the annual International Council of Shopping Centers convention, Reich gave a dim view of the nation’s economic prospects for the near term and said during an interview that Las Vegas’s recovery will take time.

“I think Las Vegas will return to health, but the question is when,” Reich said. “The recovery so far is not a strong one. My advice to Las Vegas is be patient, and good times will return, but it will take a while.”

Las Vegas isn’t going to be able to rely on middle-class Americans who come to Las Vegas to spend at higher or even the same levels as in the past because their wages aren’t increasing. And the prospect of returning to those levels doesn’t look promising, Reich said.

“The problem is the American middle class. It will take years for them to get their footing back,” Reich said.

That means the key for Las Vegas is the top 5 percent of American earners and foreign travelers, Reich said. The top 5 percent is doing well, and the global middle class is doing better because of rising wages in places such as Asia, he said.

“I think the global middle class will come to Las Vegas, and you will see more international visitors,” Reich said.

Although economists said the American economy is recovering, Reich said people should be cautious and not be fooled by what’s happening. During the first quarter — if temporary factors such as businesses increasing inventory, the effect of the federal stimulus and consumers drawing down their savings are eliminated — there was little if any economic growth, Reich said.

This isn’t a typical business cycle where there is a recovery from a deep recession like in the early 1980s, Reich said.

“It is a fairly modest if anemic recovery so far,” Reich said. “Don’t be fooled by what you are hearing and seeing about the economic recovery. There is a recovery. It is happening. It is a slow recovery, but it is not very encouraging.”

Reich said the good news is that he expects the nation’s jobless rate of just under 10 percent to drop to 4 to 5 percent in the next two years. Just because jobs return, however, doesn’t mean there is a recovery because wages aren’t growing, Reich said.

To understand what is going to happen to the American economy over the next five years is to understand what has happened to American consumers, Reich said.

The median American wages for men rose after World War II, but stopped in the early 1980s and have stagnated since, Reich said. That was offset by women entering the workforce in greater numbers in the 1980s.

Over the past 10 years, Americans relied on using their homes as ATMs to fund their spending, but they don’t have any more options today because that “coping mechanism has come to an end,” Reich said. There’s a connection between a good economy and wages in people’s pockets and ability to shop, he said.

“If people are not getting wages and are drawing down their savings, and they can’t use their homes as ATMs any more because home values are lower, no matter the consumer confidence, they are not going to have the ability to continue to shop,” Reich said. “And if they can’t shop, what happens to shopping centers?”

Many people assume the Great Recession is a product of Wall Street, and fixing the financial system and not subjecting the economy to those risks again will make the difference, Reich said. The blame is also pointed at the Federal Reserve for letting banks borrow money over the past decade for little or no interest and thus paving the way for massive amounts of lending and a lot of it risk-taking.

Fixing those issues helps, but what needs to be addressed is the effects of globalization and technology on the American workforce, Reich said.

Jobs flow overseas because businesses are trying to operate more efficiently, Reich said. That’s a good thing because it lowers the costs of goods and services.

Globalization doesn’t mean the end to American jobs. German workers have high wages and that country has a powerful export industry because its workers are well trained, educated and productive, he said.

“It is not about good jobs going to developing nations,” said Reich, who said globalization creates opportunities as well. “Our people are not getting the education they need, and it has caught up with us. It caught up with us a few years ago as your coping mechanisms ran out.”

Technology is also displacing people from the workforce, but Reich said it doesn’t have to if they have the education and training.

None of this means people will be without jobs, but the jobs they have will pay less than their old ones, he said.

“When jobs comes back, we will suddenly realize our problem is not our employment per se, but our problem over the longer term is wages — adequate wages and adequate incomes to allow people to have the buying power necessary to maintain economic growth and maintain business.”

The changing demographics create another concern, Reich said. Baby Boomers won’t retire as early as many expected because their incomes have been stagnant when they had expected to earn more money.

Others in the workforce who are waiting for them to retire so they can take the higher-paying jobs won’t be able to do so and that holds down their ability to spend, Reich said.

“You have got to be worried about the capacity of consumers to continue to spend as they had been spending before,” Reich said. “That means with retailers and shopping centers that value is more important than ever.”

Also during the conference, Tivoli Village at Queensridge, the $850 million retail and office development at the corner of Rampart Boulevard and Alta Drive in western Las Vegas, announced a March 2011 opening and said several leases have been signed.

The project initially had a fall 2009 opening, but that was delayed by the recession.

Tivoli Village said it’s leasing more than 370,000 square feet of retail, restaurant, entertainment and high-end office space. It will open with 30 to 40 retailers, eight restaurants and several fast-food outlets.

Tenants that have committed to Tivoli Village are family-activities center Kidville, Mexican restaurant Cantina Laredo, actor Joe Pesci’s pizzeria Pesci’s, Italian restaurant Brio Tuscan Grille, German eatery Ratskeller, specialty retailer CORSA Collections and Ritual Salon & Spa.

“The tenants who have joined us, align perfectly with our goal to create a high-quality dining, retail and office destination within our community. Our restaurants and retailers complement what exists today in what we know is an underserved market,” Executive Vice President Patrick Done said in a statement. “Tivoli Village is within five miles of more than 395,000 affluent residents looking for a place to gather, eat, shop and do business, making it an incredible opportunity for residents and tenants alike.”

Tivoli Village is being developed through a partnership with IDB Development Corporation Ltd. — described as Israel’s largest diversified business group with total assets of more than $30 billion — and EHB Cos.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy