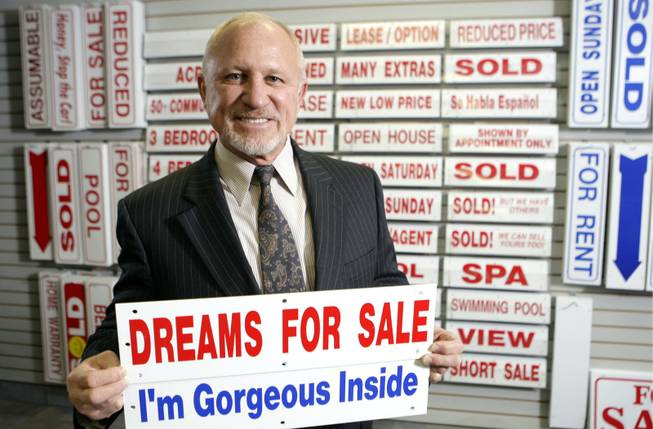

Rick Shelton, president of the Greater Las Vegas Association of Realtors, is shown in a store in the headquarters of the association, which boasts a membership of about 13,500.

Friday, Jan. 15, 2010 | 3 a.m.

Rick Shelton once dreamed of owning an auto dealership.

Now the 53-year-old former Marine is co-owner of a real estate brokerage. He has assumed the presidency of the Greater Las Vegas Association of Realtors and is leading a charge to combat Las Vegas’ foreclosure problem.

Shelton is urging the federal government to do more to encourage lenders to use short sales in which they allow homes to be sold for less than is owned on the mortgage. That would reduce the number of foreclosures and bolster prices and speed the recovery of the housing market in Las Vegas, Shelton said.

None of this was part of the blueprint Shelton drew up for his life when he worked for car dealers in Phoenix, where he grew up. He later ran finance departments in Las Vegas after moving here in 1986. But he was intrigued by the real estate profession.

“I started reconsidering what I was doing and felt I needed a shift,” Shelton said. “I had never really considered getting into real estate, but I re-examined my life and my career and between being your own boss and ultimate freedom for a work environment, it was the one avenue I always kind of looked at and was curious about.”

Shelton entered the industry on the builder side, working in sales for Richmond American Homes and Pulte Homes before opening his business. He is the owner/broker of RE/MAX Associates, which has grown to more than 200 employees.

IBLV: Why did you leave the building industry and start a brokerage?

Shelton: That was where the opportunity was. I started to realize it was a profession where the sky was the limit. When you are dealing with a builder, you are limited to his inventory, and on the resale side, the cap was so large (of what I could sell in a month).

What is your job as corporate broker?

I do all the recruiting, the conceptualization of the company, where the company is going and how we are adjusting to the times.

Did you think you would be the GLVAR president some day?

It is really a progression. As I went through the process, I grew and it was an internally evolving process. I began to feel responsibility to the greater good instead of just myself and the company. I realized the impact I could have might be significant.

What do you hope to accomplish this year?

That is an ever-moving target in this market. I think keep us aligned with where we are at. The association, from a business standpoint, runs very efficiently. As for change, I am not so certain that is where we are headed. (One goal is) probably to look more toward value added for the members and to enhance communications at different levels and disseminate information better to the membership. Therefore, the members would better disseminate information to the community, and our impact in Nevada would be at a higher level.

Are Realtors not getting the information?

It is not about not getting information. People in life choose to pay attention and participate or choose not to. Sometimes the reason people choose not to is they are not fully informed or aware of the consequences. Some people haven’t awoke yet to the difference they can make or what contribution they can have.

What can they do?

What everybody can do is work more cohesively toward a remedy and cure to get through this economy and market we are in. We have had a lot of drastic movement toward correction over the last 12 months, but we have a lot of ground to cover. We fell into a very deep crevasse, and we have to get moving to get out of that crevasse. In that, I think it is probably a broad awareness of the people in Nevada to engage more on a political level with our politicians and communicate to our politicians what our needs are. That is the question of whether it has been done properly in the past and whether the right word is moving up fast enough to D.C.

What do they need to engage in?

We can drive our own neighborhood streets and see what’s happening and what would be better or worse. We have community issues. We have people who don’t have employment. We have people who are losing their homes. I say that is a pertinent set of issues. Sometimes people are distanced from what may be happening here locally, and it is our job and duty to carry that message to them and let them know we need local help. Las Vegas doesn’t look the same as New York City or Washington, D.C. We have an atmosphere of our own here, and sometimes we may get a little neglected. I don’t think it is by intent, but due to not completely understanding our specific issues.

What are the issues?

Our issues are declining prices — prices that have frankly hyperdeflated as much as they hyperinflated. That is facilitating awesome opportunities for investors and first-time buyers. But we need some correction on the other side. We need employment back in check. How do we encourage people to come here from out of state? How do we get kids to stay here and graduate from college if we are running an unemployment level of 14 or 15 percent? Those types of issues need to get corrected. I am not on a bandstand that politicians aren’t doing their job. I believe they are wholeheartedly doing their job. I believe, sometimes, specific issues are not in the forefront of the agenda. This period we have gone through has probably quantified, at any point in time in history, that real estate is a very significant part of this country’s and state’s economy. As a trigger point, I believe real estate has had an impact on this recession occurring and our economic conditions. Conversely, I also believe that real estate can be a helping hand in pulling us out of that crevasse that we are in.

What do you want done?

We need a lot of help in our coordination with the banking relationships and how the properties are being managed as far as the foreclosure process. Frankly, it is publicly known the loan-modification process is not working too well, and frankly, I believe that it is the best solution. Whether it is the ultimate solution I am not certain, but I can say at worst case the short-sale process can and should be the ultimate solution. I don’t believe it is necessary to drag people through the mud and interrupt their family environment through the foreclosure process. There are some cases it has to happen, and that’s sad. It is just a reality and some people are going to subject themselves to that and that’s their solution. But outside of that, there is a grander cure and that cure is the short-sale process.

Why?

If we have values that have congruently realigned themselves at a new value point, then we kind of have to (figure out) how we correct that. The solution is quite simple. If the value has moved from two to one, then we need to realign our expectations to one expectation. At this point, we have had a bit of a challenge trying to get the short-sale process functional. The Treasury Department has put down a new directive effective as of April 2010. That directive is definitely a step in the right direction, but I am still concerned it is not the full answer. There are some missing components. We need to keep plugging along, and I really believe another 12 months of cooperative participation between the politicians and the local practitioners (will help). I really believe we can get to a solution that is going to be productive.

What does the directive do?

The directive creates a standardization process for the banks that choose to participate. It cleans up a lot of the problems we had previously in timelines. Short sales may have taken 10, 12 or 14 months of negotiation with the bank. That is really not acceptable because you are impacting too many parties. You have, first and foremost, the seller who doesn’t know where he stands and what the outcome will be and the buyer who is not buying it to move in 14 months from now. They are thinking about today.

What would you like to see changed?

We would like to see a much more progressive, organized short-sale system that works quickly, efficiently and to the best outcome of all parties.

Would it be voluntary?

Voluntary is the best bet. Legislation could take too long.

How much higher would prices be if there were more short sales?

The cost to the banks is established to be 18 to 20 percent. They lose more on the deal by going to foreclosure. I think it is a 20-plus percent savings for the banks to come to an early prognosis and approve the short sale as opposed to a foreclosure.

What is happening?

They are starting to. The feds have come down with this directive and I believe it is a move in the right direction, but it is still not all encompassing. There are outstanding issues. There are SEC regulations that deal with investor loans that force primary lenders to not be able to negotiate on behalf of the second (mortgage), and you wind up with a bunch of people wandering around in a circle. The second component is that it would appear that maybe it is not profitable for the servicing companies to be modifying loans or short-selling loans as opposed to foreclosing on homes. Foreclosure assures a first-place position as far as a lien. It is a known fact in the foreclosure process the servicers are first in line.

What do you think of the new state program allowing homeowners to seek mediation with lenders?

It is too new to have an opinion, but it is a step in the right direction.

What would it mean if foreclosures subside?

It means price stabilization. By withholding inventory, there has been a floor to the market that has begun to form. If we add to that the benefit of lower loss to the banks, we stop any future eroding of price and actually reverse it and start inching back up. And we return to more normalcy of what Las Vegas experienced in the ’80s and ’90s where our market moved at 3, 4 or 5 percent a year. That is a good, healthy place to be in.

Why is it good to have higher prices?

The simplicity to me is this: What does it cost to build a home? Today, the cost of the majority of homes that we see on the market are selling for less than what it would cost to construct those homes.

So this would be a big boost to the new-home market?

Until our prices meet the point where the cost of dirt and the cost of sticks and labor pencil for a builder, a builder can’t engage in this market. What we have today is just survival builders — builders that are trying to meet their payroll. They are trying to keep themselves functional as a business so they will be prepared once the market returns. That is smart business, but it’s costly business for them. They are not profitable. Until we get our median-price point back in check, the builders can’t re-enter. We are going to need a builder re-entry over the next 24 to 36 months or we are going to have a dramatic inventory deficiency.

What do you see happening in the next 12 to 24 months?

My personal feelings from what I see on a daily basis in our market and what I see in the national level in the mentality of national politicians is a migration in our direction. I believe everybody is starting to better understand what the causes and effects are in the equation, and everybody is starting to work more toward the middle than they were 18 months ago. I believe 2010 is going to look a lot like 2009. It will move at the same momentum and same tempo. And I think we have a lot of positive things on the horizon that are going to be in play in 2010 that I think should have us started back on track starting in 2011.

Is the worst behind for Realtors and brokerages?

My gut instinct is yes, it is behind us. What we saw in 2007 and 2008, by my interpretation, that’s as bad as I have seen, as challenging as I have seen and lacking in hope of any period I have ever seen. It was compounded by our national financial crisis and our economy. But I think we are still on tenuous ground. We have $1.6 trillion in option ARMs (adjustable rate mortgages) maturing between March 2010 and the end of 2011 and how we deal with that inventory as a country is going to dictate 2011 and 2012. That’s why it’s imperative that we embrace what we have today and we really broaden our scope and open our minds to remedies that are functional.

We have established as a country that we are willing to throw government dollars at curing a problem. If we have accepted that mentality and accepted our future responsibility as taxpayers, I would suggest it needs to be deployed to those who are in need. I am not talking about the homeless person on the street. I am talking about the homeowner. Let’s start at the beginning of the problem and let’s help the people en masse in the best way we can. I am not talking about handouts. I am talking about dealing with this crisis in the easiest, fastest and most expeditious manner and retain property values, continuity of neighborhoods. We don’t want lot rot and we don’t want deterioration of properties. I believe all the things we have seen over the last 24 months could be remedied through the short-sale process.

Will the homebuyer tax credit extension help?

Absolutely. That was imperative to keep the wheels on the cart. What we have tracked and seen year to year and year over year, 2008 over 2007 is a constant better, better, better better, better. The trend is right. What we need to do is maintain the trend. We don’t want to reverse the trend. It is fragile, maybe not as fragile as it was 12 months ago, but it is fragile. We need to handle it cautiously and not mess with what’s working. The first-time homebuyer tax credit was working. It has re-engaged the buyers who have a want and need to buy. That is a not a vehicle for investors, so it is not a vehicle that can get abused.

What is the membership ranks today of the Greater Las Vegas Association of Realtors?

We are about 13,500. We are holding constant to a year ago. We have definitely suffered loss, but what we have experienced on a consistent basis is new people getting into the business. I would tell you it is driven by people losing their jobs. We have seen the profile of advanced education and professional is little different from what we have historically seen. We are seeing architects and people from those types of fields.

What does that mean for the industry?

They bring great expertise to the table. A lot of people are education-based, creative-based or professional-based. They have an expertise that I see is a good fit with the real estate industry.

Why?

Hopefully it would be a move forward for a more technology-based level because it is certainly where I think the industry is headed based on the tools that are available.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy