Chris Morris / Special to the Sun

Monday, Feb. 15, 2010 | 2 a.m.

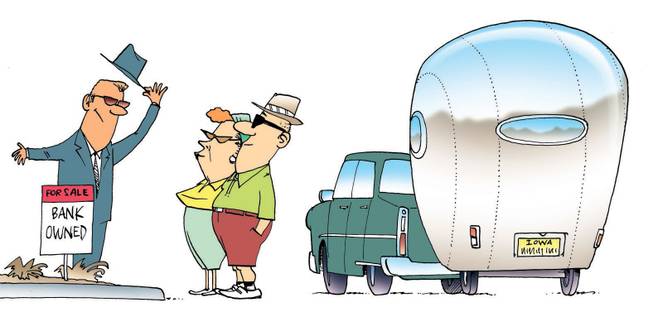

If real estate agents are applauding the historic snowfalls pounding the Midwest and Northeast, little wonder.

History tells us that blizzards prompt snow-weary homeowners to move to Las Vegas, and the depressed housing market is making that all the more attractive.

With a 60-percent decline in home prices in Las Vegas since 2006, the valley is certainly an attractive option to homebuyers tired of wielding snow shovels.

Las Vegas has been relying on investors and first-time homebuyers to swoop up a lot of the inventory triggered by foreclosures — but Realtors and housing analysts note it is uncertain how much longer that market can be tapped.

Enter the snow factor.

“We’re expecting the most recent weather along the East Coast will make more people relocate to the Southwest,” said Linda Rheinberger, president of the Nevada Association of Realtors and owner/broker of One Source Realty in Las Vegas. “Some people are fixated on Arizona and New Mexico, but they are open to the opportunity in Las Vegas, especially with the undervaluing in housing. They know they can buy at such a great deal.”

Homeowners looking to upgrade have remained on the sidelines because many are unable to sell their homes after values have declined so much. And there are no jobs to speak of to lure new residents.

That means retirees could be an important piece of the puzzle until the economy recovers. And who hates snow more?

“I believe they could be an even more important component,” Rheinberger said. “Unless we concentrate on job creation, we are forced to consider retirees and people who are not subject to the job market as a crucial part of our economy.”

Rising home prices in the past decade shut out many seniors who might have wanted to retire in Las Vegas. Now they may be ready to pounce, said Bob Hamrick, president of Coldwell Banker Premier.

One analyst suggests people 60 and older comprise 16 percent to 17 percent of the market today. Watch that number rise by as much as half, Hamrick said.

Demographics are on Las Vegas’ side, too.

The first of the Baby Boom generation turns 65 next year and those in a financial position to do so are looking to warmer climates for retirement, said Steve Bottfeld, executive vice president of Marketing Solutions.

“I think seniors are going to be the next wave of buyers,” Bottfeld said. “What you are going to see is a strong movement here beginning this year and peaking in 2012 and 2013. A lot of people are looking east but look at California (instead). There are a lot of people who want to get out of the congestion and want a simpler life. It is a much lower cost of living (in Las Vegas), and most important is the lack of a personal income tax.”

Thirty-two million people will turn 65 from 2010 to 2030 and 30 percent will move at least once during retirement, according to Applied Analysis.

The U.S. Census Bureau projects that from 2010 to 2020, Nevada will see a 61 percent increase in residents 65 and older.

Bottfeld said seniors will be in a better position in the next couple of years with the stock market rebounding. In addition, they can qualify for loans more easily than many other buyers,

“We are the single most underpriced city in the country. A lot of people are looking at us and saying, ‘It is a bargain,’ ” Bottfeld said.

Rheinberger said one reason Realtors nationwide pushed for an expansion of a tax credit of $6,500 for existing homeowners was in part to target seniors who want to move. That extension expires June 30, she said.

“They are less subject to the whims of the marketplace,” Rheinberger said. “They have a stream of income that is defined, whereas those who have to work to support themselves are in a worse position.”

Although Las Vegas will attract a lot of seniors, it won’t be the first choice of many, according to a 2010 Del Webb Baby Boomer survey. It shows about one-third of seniors plan to move to a new home during retirement and 50 percent of those who plan to move will go out of state.

North and South Carolina were at the top of the list of places to move to followed by Florida, Tennessee, Virginia, Arizona and California. Nevada didn’t make the top tier of states.

John Restrepo, principal of Restrepo Consulting Group, said competition among states for seniors will be fierce. The primary attractions include cost of living, entertainment, availability of medical services, weather, tax structure, proximity to family and work opportunities. Southern Nevada rates high for some factors, such as cost of living, including housing prices, entertainment and tax structure, but not so well in others such as health care services and job opportunities, he said.

“But retirees want a complete set of senior-related services and amenities to attract them to a community or region — not the least of which are health care services and even jobs,” he said.

Dennis Smith, president of Home Builders Research, said he is telling clients to watch the trend of seniors relocating, which also will help bolster the new-home market.

He suggests that the housing industry focus more marketing efforts on retirees who eschew Las Vegas because it is perceived as Sin City.

Restrepo said it’s worth discussing whether public dollars should be spent to attract retirees, but his research suggests that middle- and upper-income retirees are sophisticated enough to know the qualities and amenities of the various Sun Belt regions they are considering.

A version of this story appears in the current issue of In Business Las Vegas, a sister publication of the Sun.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy