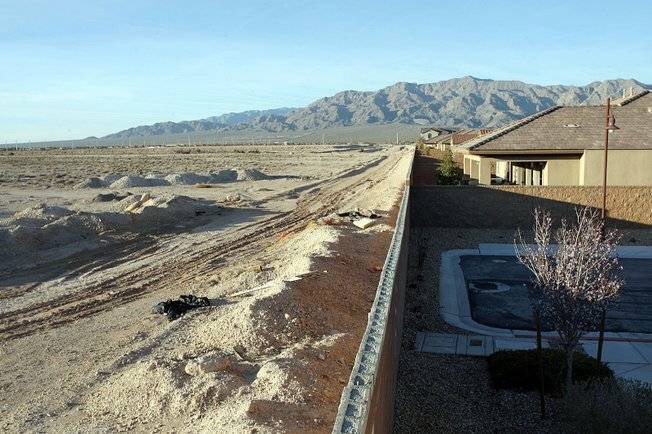

Steve Marcus / Las Vegas Sun file photo

The vacant desert at left was to be developed as Park Highlands, a 2,675 acre community in North Las Vegas. Work began in 2007 with the expectation that people would begin moving in in 2008. This year, the projection for completion of the first homes was moved to 2010, but legal battles continue.

Thursday, Sept. 17, 2009 | 3:09 p.m.

Sun Archives

- Park Highlands developer files for court’s protection (5-18-09)

- Stalled NLV development files for bankruptcy protection (5-12-09)

- Big NLV project down, not out (2-27-2009)

- Developers: With slump and all, just writing to say we’re OK (6-6-2008)

- Neighbors aren’t sharing alarm over casino project (4-28-2008)

Planned development

The massive but stalled Park Highlands residential development in North Las Vegas says it's gained concessions from lenders and is ready to emerge from bankruptcy.

Park Highlands says secured lenders holding a majority of its debt have agreed to the concessions in the Chapter 11 reorganization case, and that unsecured creditors owed about $1.6 million would be paid within two months of plan confirmation.

But not every party involved in the case is on board with the plan, and three formal objections have been filed in U.S. Bankruptcy Court in Las Vegas.

Park Highlands developer November 2005 Land Investors LLC filed for bankruptcy protection May 8.

The project sits on 2,675 acres near the Las Vegas Beltway and Decatur Boulevard. The property was acquired for $639 million at a 2005 Bureau of Land Management auction and development efforts were led by Southern Highlands developer Olympia Group and Fort Worth, Texas-based homebuilder D. R. Horton Inc.

Ground was broken in 2007, but after the recession set in, work was halted on the project. It was planned to include 15,750 homes, schools, parks, casinos and other amenities.

Records show D.R. Horton had bought about 20 percent of the acreage for $127.8 million, but later sold its interest in the project. It's now a creditor in the bankruptcy case and is engaged in litigation with Park Highlands over an agreement for funding the project's infrastructure.

Court records show that before the bankruptcy, members of the development group contributed $199 million in capital and also purchased 417 acres of the project for $222 million.

Records show lenders and creditors have asserted claims in the bankruptcy case of $267 million against the project, including $235 million in secured claims.

The largest creditor is lenders' administrative agent Credit Suisse Cayman Islands Branch, which developed a reputation for risky lending practices this decade during the economic boom before the recession set in. That bank has filed a claim in the case for $144.7 million. Another big creditor is another lending agent, Wilmington Trust Bank, which filed a claim for $82.2 million.

Court records show much of the debt has been sold and is now held by about 36 lenders.

A recent appraisal found the property tied up in the bankruptcy case is worth about $160 million.

Under an arrangement with certain lenders, $34 million in debt will be canceled, up to $8 million of a debtor-in-possession loan will be converted to equity and the Park Highlands investors and affiliates will provide $3.65 million in cash for operating expenses and other costs.

Park Highlands' owners said in court papers that, with concessions from many of the lenders, it intends to emerge from bankruptcy as a viable entity.

"Notwithstanding the current economic environment, November 2005, (NLV Holding LLC) and other related entities remain committed to the project and believe that the project remains very viable as the economy recovers," the Park Highlands developer said in a disclosure statement filed last month. "The members have made significant investments in the project from their own funds."

But D.R. Horton, in objecting to the plan, said it's owed $31.8 million as a creditor under the infrastructure development agreement. Park Highlands' developers dispute this and have sued D.R. Horton, claiming it owes $5.9 million under the development agreement.

Still, D.R. Horton charged in court papers opposing the reorganization plan that Park Highlands owes it money and "debtor has made no showing that it is capable of paying" the debt.

"Debtor's source and use of cash provides only enough cash for debtor to survive until March 31, 2010," attorneys for D.R. Horton argued.

March 31 is when major loans come due, though they could be extended under certain circumstances.

"The plan is a liquidation in disguise -- promising nothing more than a few months of life prior to liquidation," D.R. Horton complained.

D.R. Horton charged that the reorganization plan includes information on how obligations to lenders will be met, but is ambiguous on how other creditors will be paid -- for instance saying future fund sources include potential post-bankruptcy operations or sale or refinancing of all or part of the project.

"The disclosure statement contains no discussion or description of what debtor's 'operations' will consist of or who might provide any 'contributions' or 'financings,"' D.R. Horton said in its filing.

Similar complaints were lodged by a committee of Credit Suisse-related lenders that did not participate in a debt exchange deal in which Park Highlands agreed to pay $13.5 million to buy back at distressed prices -- and extinguish -- $47.9 million of its own debt.

These lenders say the debt-exchange deal is invalid since all the lenders did not agree to participate.

These lenders, associated with Credit Suisse Alternative Capital Funds, say they are owed $6.8 million.

They charge that Park Highlands has no hope that it will survive after bankruptcy under its plan, arguing its income will be insufficient to cover monthly interest payments of $397,000 on the $177 million in debt that will remain after the bankruptcy.

The lenders noted that debt would come due on March 31 -- subject to extensions, but only if Park Highlands is not in default.

"The debtor's property consists of undeveloped land and the plan does not provide for sufficient funds to develop the land," the lenders complained.

They said that while Park Highlands has expressed hope that the Las Vegas housing market will rebound so builders will purchase property in Park Highlands, the Bankruptcy Code bars "confirmation of visionary schemes that promise creditors more under a proposed plan than the debtor can possibly attain after confirmation."

"The plan is likely to be followed by a need for liquidation or further financial reorganization," their attorneys argued.

But Park Highlands, in court papers, said its reorganization plan is feasible and is more favorable to creditors than a Chapter 7 liquidation, which it said would result in second-lien holders owed $81 million and unsecured creditors receiving little or nothing.

Also filing a precautionary objection to the plan were attorneys for the city of North Las Vegas. They said they want to ensure that the reorganization plan confirms the city's development, infrastructure, parks and trails agreements with Park Highlands.

An Oct. 1 hearing is planned on Park Highlands' plan to emerge from bankruptcy.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy