Monday, Sept. 14, 2009 | 2 a.m.

Sun Coverage

Southwest Gas last week tried to persuade the state Public Utilities Commission to approve an increase in the general rate that consumers pay to cover the company’s operating expenses.

But even if Southwest Gas gets everything it is asking for, consumers are still likely to see an overall drop in their bills.

That’s because most of a Southwest Gas bill reflects the cost the company incurs purchasing and transporting natural gas to customers. The price of wholesale natural gas is taking a nose dive and appears very unlikely to rise in the near future.

Southwest Gas last week tried to persuade the PUC to increase the general rate portion of bills by 5.9 percent. According to documents filed with the commission and comments by company spokeswoman Cynthia Messina, the rate increase would cover rises in operating and administrative costs as well as the cost of maintaining the state’s natural gas infrastructure, which has grown with the population since the last rate case in 2004.

The increase the utility company is seeking would generate about $28.8 million for Southwest Gas each year. It would increase the average residential bill by a couple of dollars a month.

Consumer advocates say the company is being greedy. PUC staff want the company’s increased revenue lowered to $12.4 million. The state attorney general office’s Consumer Protection Bureau thinks $10.7 million is reasonable.

That’s partly because it doesn’t approve of some of the losses Southwest is trying to recoup through the general rate. In written and oral testimony to the PUC this week, consultants for the state objected to Southwest Gas’ request that ratepayers reimburse the company for such things as supplemental executive retirement compensation and the loss in equity to homes the company purchased from employees it relocated, among other things.

The retirement and home equity reimbursement requests alone account for more than $2.75 million, according to testimony from the consumer advocates’ consultant, David Effron. These are expenses ratepayers have never had to pay for in the past, and for which the PUC has declined compensation in earlier rate cases.

But even if the PUC gives Southwest Gas the rate increase the company wants, that isn’t likely to outweigh the benefits consumers are likely to see from falling natural gas prices.

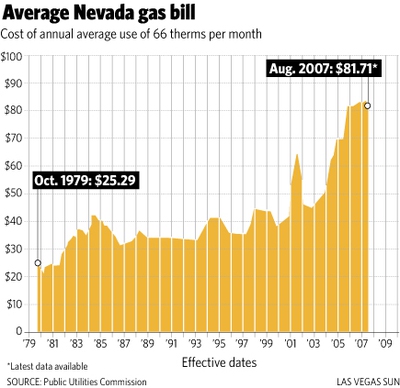

About two-thirds of the average natural gas bill for residents or businesses is based on the cost the utility company pays for fuel. For a decade the cost of natural gas has risen in fits and starts. Supplies in Canada were plateauing and the domestic supply was interrupted by a bad hurricane season in 2005. At the same time, regulators turned a blind eye to manipulation of the market by investors.

Those factors affected winter heating bills, operating costs at industrial plants and summer electric bills, among other things. About 70 percent of Southern Nevada’s electricity is created in natural-gas-fueled power plants. The cost of that fuel is passed directly on to customers of electricity. Natural gas streetlights in some parts of Las Vegas were shut off in recent years because the bills had gotten too high.

But changes in oversight of the natural gas market have reversed that trend, in part. Experts said the previous presidential administration’s hands-off approach allowed hedge funds and other investors to manipulate the oil and natural gas markets, causing prices to rise unnaturally.

Under the Obama administration, regulators have been pressured to keep a closer eye on transactions.

Just last week the U.S. Energy Information Administration announced the launch of an energy and financial markets analysis team that is to help the agency gather and analyze data to better understand the effects of market manipulation, speculation, hedging, investment and exchange rates on energy prices.

Experts said this and other improvements to regulatory oversight have had a stabilizing effect on the markets.

So has the recent windfall of new natural gas sources.

Natural gas producers suddenly have far more fuel on their hands than analysts expected. The natural gas drilling stations on the Gulf Coast destroyed in Hurricane Katrina were rebuilt much more quickly than expected. And suppliers discovered new pockets of the fuel and developed and improved technology to extract natural gas from sources that were previously too hard to reach or too expensive to exploit. New technology and improved techniques for extracting natural gas have opened up massive natural gas deposits in underground shale and coal.

“The news around domestic production has been very good,” said Chris McGill, managing director of policy analysis for the American Gas Association. “The sources we’re so excited about today when we talk about natural gas supply growing are due to these unconventional sources. They have put us in a position in the U.S. where we view our future as one in which our supply is very robust.”

At the same time Americans have begun using less natural gas. Industrial plants that used large quantities of natural gas have been shuttered or have cut production amid the recession. And with the national push to buy energy-conserving appliances and make homes more energy-efficient, residential demand for natural gas is declining. That means a glut in supply. Natural gas storage in the U.S. is up 19 percent from last year and is 18 percent greater than the five-year average. That’s expected to continue to rise until winter sets in, according to the American Gas Association’s August market update report.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy