Thursday, Sept. 18, 2008 | 2:01 a.m.

As Republican presidential nominee John McCain refines his responses to the worst financial market meltdown since the Great Depression, Senate Majority Leader Harry Reid has been providing another story line -- one that blames McCain for the problems.

Sun Topics

“The financial turmoil we’re now seeing is a direct outcome of the irresponsible Bush-Cheney approach to governing, which, by the way, John McCain has supported every step of the way,” Reid said on the Senate floor Wednesday.

The Nevada Democrat had begun his assault earlier in the week, comparing McCain to Herbert Hoover, the Depression-era president who famously failed to see the economic disaster ahead. McCain gave Reid the opening by maintaining that the fundamentals of the economy were strong even as the storied Lehman Brothers investment house disappeared before the nation’s eyes and the stock market was taking its biggest plunge since the 9/11 attacks.

Reid has leveled particular scorn at former Sen. Phil Gramm of Texas, who served as McCain’s campaign co-chairman in July in the face of criticism after dismissing emerging economic troubles as a “mental recession” and calling Americans a nation of whiners. Gramm is now an unofficial adviser to McCain.

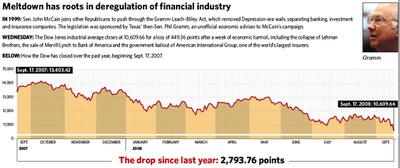

Democrats, including presidential candidate Barack Obama, are taking aim at Gramm for orchestrating passage in 1999 of a vast financial industry modernization bill that knocked down market protections in place since the Great Depression.

Critics blame that bill for the today’s financial breakdown.

“Just look to the man John McCain hired to tell him what to say on his economy,” Reid said Wednesday. “The last person I want whispering in the ear of the next president of the United States is the chief architect, the No. 1 cheerleader for the elimination of responsible oversight.”

Reid suggested that the Bush administration Justice Department had been lax in prosecuting potential criminal violations in the markets, saying the department “has not touched these conspiracies, economic conspiracies, going on. They’ve ignored it.”

The White House, for its part, has repeatedly pointed the finger at Congress, saying lawmakers were slow to act on administrative proposals to fix mortgage giants Fannie Mae and Freddie Mac or modernize the Federal Housing Administration, until it passed legislation when the crisis intensified this year.

White House spokeswoman Dana Perino on Wednesday again said the Hill shares the blame.

“For critics who are suggesting, or trying to affix blame to the administration, I would ask them to go back and do a little bit of self-examination before they start addressing us,” Perino said.

“I would ask, you know, what specific regulation, could they name one, that we sought to weaken when it came to regulating these financial markets? I don’t think that they could.”

The financial overhaul that Gramm pressed in the Senate and President Clinton signed greatly modified laws that have been in place since 1933, when the country was in the throes of the Depression.

That year, Congress passed the Glass-Steagall Act, which essentially established a wall between banks and securities companies to prevent conflicts that could arise if banks were in the underwriting business.

Financial interests sought for years to chip away at the act and succeeded when Congress passed the Gramm-Leach-Bliley Act in 1999. It essentially wiped out the recession-era law and allowed the financial conglomerates of today to operate with far less government oversight.

In the book “Chain of Blame — How Wall Street Caused the Mortgage and Credit Crisis,” co-author Paul Muolo describes how, during the go-go real estate boom of the past several years, underwriters worked in “factory”-like settings, approving one home loan an hour, for contractors hired by Wall Street companies.

“This is where the rubber met the road and if no one’s paying attention that’s when you get in trouble,” Muolo said during a talk this week in Washington. “Now we’re in trouble,” he said.

“If Glass-Steagall was never torn down, we’d never have this problem.”

Bill Riggs, a spokesman for the Republican National Committee, notes that Reid, too, voted for the Gramm bill.

Reid’s record shows he initially voted against it before ultimately voting in favor after changes were made to restrict discriminatory red-lining, he said Wednesday.

Riggs said, “Americans are calling for bipartisan leadership on the economy, but Harry Reid and Barack Obama are responding with partisan attacks, dismissive mockery, and economic conspiracy theories.”

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy