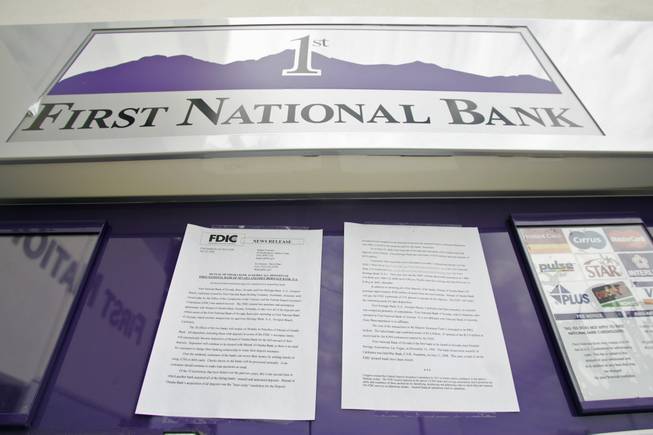

1st National Bank of Nevada was taken over by the Treasury Department’s Comptroller of the Currency Office.

Published Friday, July 25, 2008 | 6:53 p.m.

Updated Sunday, July 27, 2008 | 11:58 a.m.

A Nevada bank is the latest casualty in the financial crunch affecting banks across the country.

1st National Bank of Nevada was taken over by the Treasury Department's Comptroller of the Currency Office, federal banking officials announced this evening.

1st National merged with 1st National Bank of Arizona in late June. It had $3.4 billion in assets and $3 billion in deposits. The bank's holding company is headquartered in Scottsdale, Ariz.

The comptroller office "acted after finding that the bank was undercapitalized and had experienced substantial dissipation of assets and earnings due to unsafe and unsound practices," according to a news release. Those practices, the release said, "weakened the bank’s condition."

The most recent major bank casualty was California-based IndyMac Bank, which failed July 11.

1st National is nationally chartered and will be managed by Mutual of Omaha Bank, Federal Deposit Insurance Corp. spokesman David Barr said. It will reopen Monday.

1st National, based in Reno, has 10 branches, including five in Las Vegas.

Because the bank is FDIC-insured, individuals with $100,000 or less in a single account, or joint accounts up to $200,000, are fully insured by the federal government.

The FDIC also insures other accounts, such as individual retirement accounts, up to specified limits.

Barr described the takeover as a FDIC-facilitated change of ownership.

"(Customers) should view this as a positive," he said. "We're taking an unhealthy bank out of the system and replacing it with a healthy one."

Depositors have all been protected and can continue to write checks, use their debit cards and conduct other bank business, he said. Customers can phone the FDIC at (877)275-3342 or (866)806-5919 for information regarding the takeover.

Bank customers can find out more about the bank at this Web site. Mutual of Omaha says the transition for customers "will be seamless."

The last Nevada FDIC bank to fail was Dec. 14, 1990, when Frontier Savings Association, Las Vegas, failed. This year, seven FDIC banks have closed across the nation, according to the FDIC.

(Editor's note: This story has been corrected. In an earlier version it said the Comptroller of the Currency Office was part of the FDIC instead of the Treasury Department.)

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy