Monday, Aug. 11, 2008 | 2 a.m.

Lake Las Vegas Bankruptcy

The struggling housing market is forcing a Henderson master-planned community into bankruptcy. Plus, the federal government is investigating IndyMac on allegations of mortgage fraud. In Business talks with the managing director of Wachovia Securities of Las Vegas about the local impact on the financial industry.

Sun Topics

The slumping economy and credit crunch are catching up to the luxury home market in Las Vegas.

What had been the last holdout and strength of the housing market just 16 months ago is taking a bigger hit than the market as a whole.

“What has happened to the luxury market is what happened to the rest of the market,” said Steve Bottfeld, executive vice president of Marketing Solutions. “The key culprit is not demand nor desire, but ... the inability to get loans for this kind of product.”

Sales of $1 million-plus homes and condos have dropped dramatically, according to

SalesTraq, which compiles statistics in Las Vegas. In the first six months of this year, 161 luxury homes sold — less than half the 343 reported at the same time last year. On the whole, home sales fell just 11 percent.

More a third of luxury homes are purchased as second homes, Bottfeld said, and the percentage is even higher when looking at high-rise condos. Two years ago, buyers could get loans with nothing down, but that’s no longer the case, he said. Some lenders have even backed out of some aspects of the luxury market, he added.

The credit crunch is affecting all market segments, and pressure has tightened the most for high-end loans, analysts said. That is taking a lot of buyers out of the marketplace.

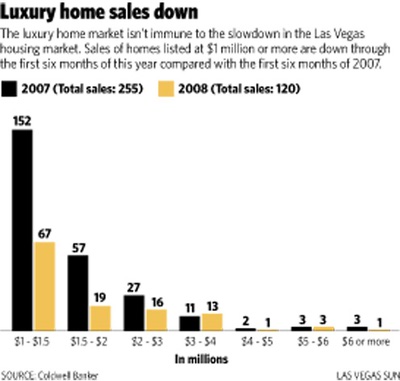

In its midyear report, Coldwell Banker Premier Realty said the biggest weakness in sales of luxury single-family homes was in those priced from $1 million to $2 million. Overall, sales dropped from 255 during the first six months of 2007 to 120 this year, according to Coldwell Banker.

Las Vegas is not recession-proof, as some believed, and neither is luxury real estate, said Bob Hamrick, president and chief executive of Coldwell Banker Premier. “It is hard for one market segment to be unaffected in an overall down market.”

The future remains bright because of the development under way in Las Vegas, but this down cycle could easily last through 2010, Hamrick said.

Others think it will take even longer to recover, especially because Echelon has suspended construction.

“I think when you see that happen, there is no way you can spin that into something positive,” Hamrick said. “You just have to live with it.”

At the end of June, the Multiple Listing Service had about 1,200 homes priced above $1 million for sale.

In some cases, sales in the luxury market are down because the homeowner may not need to sell and is reluctant to drop his price, Hamrick said. Homeowners “are not as motivated to make it happen and can wait. If they have to move, they are going to respond to the market and make it happen.”

Many buyers of luxury homes are people moving up from less expensive homes, and if they are having trouble selling those, they will postpone their purchase, Hamrick said.

“A lot of buyers are not making the step at this time because of consumer confidence and concerns of the market,” Hamrick said. “But it is the best time to move up because whenever the market is moving down, you’ve got a greater potential of making money.”

Dennis Smith, president of Home Builders Research, said sales in the luxury market won’t improve until owners drop prices and the credit crunch improves. Many luxury buyers don’t have the patience to go through the extra hoops to obtain financing because they have money tied up in other investments.

“I think like everything else, it will pick up as the financing improves,” Smith said.

Despite recent problems with the high-end market, Bottfeld reminded that only two homes priced more than $1 million were sold in Las Vegas in 1995.

A version of this story appeared in In Business Las Vegas, a sister publication of the Las Vegas Sun.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy