Monday, July 8, 2013 | 2 a.m.

Tony Hsieh has big plans for the redevelopment of downtown Las Vegas, as his company, Zappos, prepares to move up to 1,500 people into old City Hall in the center and heart of old Las Vegas.

But despite spending well over $100 million to purchase dozens of acres of downtown property — old motels, empty lots, empty storefronts and more empty lots — Hsieh’s Downtown Project isn’t the only player in downtown’s "SimCity" game to rebuild the area.

Downtown Project has dedicated $200 million to real estate. The Sun earlier this year reported Downtown Project's purchase of 90 parcels totaling 50 acres for $110 million. Most of those purchases have been made since the start of 2012.

With additional purchases since then, Downtown Project’s total comes to about $193 million, said Geoffrey West, investment specialist with Cushman & Wakefield Commerce, a commercial real estate firm.

But that’s only half the story. Hsieh and the Downtown Project may have begun downtown’s revival, but others are following.

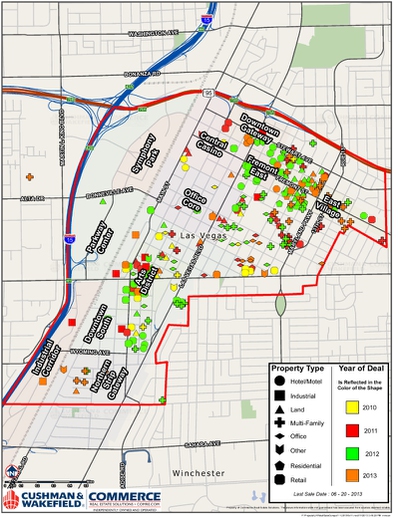

Additional data collected by Cushman & Wakefield show in a select downtown area defined roughly by U.S. 95 north, the Union Pacific railroad tracks west, Oakey Boulevard south, and jogging northeast from Las Vegas Boulevard to Bruce Street, a total of $390 million in commercial real estate has been purchased since 2010.

Year by year, it looks like this:

2010: 24 properties for $92 million.

2011: 45 properties for $29 million.

2012: 90 properties for $155 million.

2013: 50 properties for $114 million (through June 20).

A map of those properties shows what most who follow downtown already know: many properties purchased are downtown near the Fremont East Entertainment District with the second most clustered around the Arts District, generally located near Charleston Boulevard and Main Street.

In between those two clusters lies something of a no-man’s-land, a gap in purchases and sales indicative of little movement in retail, office or other business ventures, said Dan Palmeri, office specialist with Cushman & Wakefield Commerce.

“We need to be able to fill those gaps for the walk between Soho Lofts and Juhl,” he said, referring to two multi-unit residential buildings that went up during the boom years, “between Main Street and Commerce, between the Arts District and Fremont East.”

West said the “lack of investment in the connecting areas creates isolated pods of activity rather than a truly interconnected downtown.”

Make no mistake, Palmeri added, downtown’s emergence is dramatic.

He remembers a time when businesses wouldn’t locate in the city proper because they didn’t want their address to include “Las Vegas.”

“It’s that sin perception,” he said.

Yet office space, at $115 million, accounts for the largest property purchases over the past four years collected by Palmeri and business partner Geoffrey West. Multifamily properties account for the second-highest amount of purchases, at $78 million, followed by hotels/motels, $76 million; land, $46 million; and retail, $42 million. Industrial and “other” made up $31 million.

Also, the two biggest years are 2012 and 2013. West and Palmeri marvel at the sheer volume of purchases over that time, given it has really only been about 18 months since the Downtown Project’s purchases began. The volume of sales in 2013 alone almost exceed 2010 and 2011 combined.

Now other businesses are actively looking for commercial office space downtown, Palmeri said, even though it’s hard to come by.

So “now it’s a matter of private developers coming in, buying some buildings and even putting some buildings up,” Palmeri noted, adding that in older cities like San Francisco, San Diego and Denver, older buildings ripe for renovation are plentiful downtown. “But here you don’t have that.”

One hurdle is that as Downtown Project partners started buying, they “created their own competition,” as Geoffrey West, Cushman & Wakefield investment specialist put it.

Prices for existing office space, which is scarce already, are relatively high and the cost to build keeps going up with improvement in the local economy.

“This is probably the only large city where you need pure ground-up development,” Palmeri said. “You’re not going to take existing buildings and retrofit them because there just aren’t enough of them around.”

Examples of need for office space abound. Palmeri talked of one client, an advertising firm, he found downtown space for within the past few years. The firm has grown from four to 10 employees and needs more space.

It needs about 3,000 to 3,500 square feet, about double its existing space. The firm can’t afford to move into Class A office space, which rents for about $2.50 to $3 a square foot, plus the $75 to $100 per month it costs to rent each parking space.

Below the Class A buildings, such as Molasky Corporate Center, the Bank of America building and a few others, there are few options.

So what’s going to happen? Eventually, someone’s going to step up to the plate and fill a growing residential need; and when businesses see more people living in the area, they’ll follow through with retail and office space needs.

“There’s still a huge need for rooftops,” Palmeri said, and he’s not talking about the kind that make up “lawyers row.”

Years ago, the city failed to create a historic designation for a huge swath of downtown — roughly from Maryland Parkway west to Las Vegas Boulevard, and Charleston Boulevard north to Carson. Doing so might have prevented the conversion of dozens of homes in that area into law offices.

Then again, no one wanted to live downtown and no one had the foresight to see the value in homes close to the city’s center.

“So you have all those homes on lawyers row, but nobody lives in them,” Palmeri said.

A need for mid- or high-rise buildings will build, he said. And not the “need” of seven or eight years ago, when nearly 100 high- and mid-rises were planned for the Las Vegas Valley, most of those stemming from the faith that out-of-towners would be willing to plunk down $500,000 to $1 million for a condo that they would stay in a few times a year.

Housing is now needed for people who actually live here.

“People don’t seem as transient as they used to be,” Palmeri said. “You’re starting to see them move here and stick it out. I know when I lived downtown, it was the first time in 11 years I had that sense of ‘home.’”

What will be interesting to watch is where multi-unit residential units go up. “Lawyers row” could be targeted, Palmeri said, and that might cause a little backlash when some of those older homes are targeted for demolition.

“It will be interesting to see who steps up,” he said, adding that what happens will be “a new kind of construction, with retail on the first floor, office on the second, then residential above that.

He is fairly certain it’s coming.

“Everybody wants to see this happen and help it grow,” Palmeri added. “The cool thing about Vegas is, when you build something like this you’re really helping shape the city. And I don’t know where else you can do that.

“Sure, Tony (Hsieh) is playing his own game of 'SimCity,' but other developers have that ability to do it, as well.”

Joe Schoenmann doesn’t just cover downtown, he lives and works there. Schoenmann is Greenspun Media Group’s embedded downtown journalist, working from an office in the Emergency Arts building.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy