The Clark County property assessment roll is expensive for the government to produce each year.

Friday, Jan. 11, 2013 | 2 a.m.

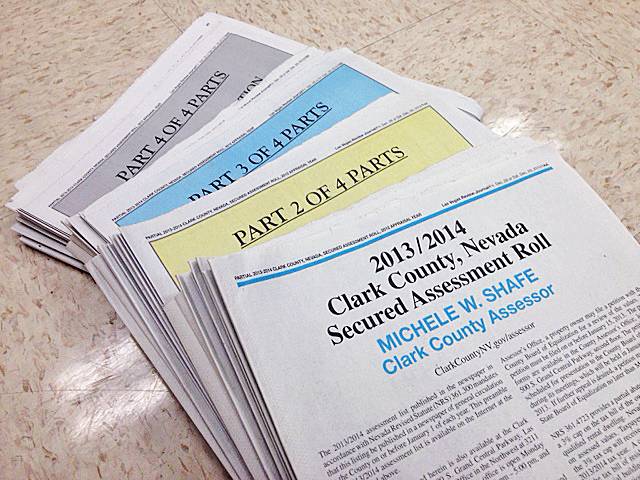

The Clark County property assessment roll — a thick, four-section packet that costs hundreds of thousands of dollars to publish — hit the driveways and doorsteps of Las Vegas Valley newspaper subscribers in late December.

The roll is an epic collection of public information, listing the assessed value of all 728,000 parcels of land in the county. Each copy weighs 4.5 pounds and is published on several hundred pages of newsprint. But whether there will be an edition next year is the subject of debate.

The roll is available year-round online, but the county is required by state law to publish a hard copy every year. This year, the cost was about $580,000.

The roll and other public notices are one form of government transparency codified into the Nevada Revised Statutes, but Assemblyman Paul Aizley says the availability of the information online makes it a waste of public money to print the assessment roll.

“Right now, we could use that money other places,” said Aizley, who represents a district covering parts of Henderson and the Enterprise township. The assessment roll “is on the web. It’s accessible. There’s no reason why we need to do it in the newspaper."

Aizley has introduced a bill and an amendment in the past two legislative sessions allowing municipalities to post the rolls only on their websites, but both measures have failed — often amid concerns that residents in rural counties with less reliable access to the Internet would suffer from the change.

Aizley said he intended to introduce another bill in the upcoming session that would exempt only large counties — specifically Clark and Washoe counties — from having to distribute printed copies of the roll.

“Spending money for some reason that you don’t need to spend it on is wasting money,” he said.

The Clark County assessment role was distributed to the more than 100,000 Las Vegas Review-Journal subscribers during the last week of 2012, assessor Michele Shafe said.

“The purpose of the assessment roll and having that available to the public is so property owners can compare their properties to other similar properties,” she said. “Especially in residential neighborhoods, they can compare the value of their house to their neighbor’s house and make sure they’re being treated equitably.”

Shafe said the county has posted the roll on its website for at least the past 16 years. She said the online system is often easier for people to use than the printed copy.

Although the costs may be steep, publishing the assessment role and other public notices in print are an important way of monitoring and verifying the work of the government, said Barry Smith, Nevada Press Association executive director.

“Public notices are in the law because they have to do with actions by government that are so important that the law says the public needs to be notified. Not that they’re just made available, all records are available to the public if you want to go look them up … but that there needs to be some positive action to get it out in front of people so they know what’s going on,” he said.

Publishing the assessment roll through a third party forces the government to be accountable, he said.

“The role traditionally held by newspapers is of a third party involved in the publication so it’s not just government accountable to itself,” he said. “With printed public notices, there’s an affidavit of publication. It’s there in perpetuity so there’s a hard copy there to refer to, to show that, yes, this notice was published and out in front of the public.”

Smith said he supported posting public notices online and thought there were more cost effective ways of delivering the assessment role in large counties. But, he said, if the information is posted online only, governments need to find ways to secure the data, make their websites easier to navigate and find new ways of notifying the public where the information can be accessed.

“You can look something up (online) the same way you can go down to city hall to look it up. That’s not the same thing as notifying,” he said. “Publishing it is a cost, but it’s the cost of government accountability and transparency.”

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy