Wednesday, Nov. 2, 2011 | 11:17 p.m.

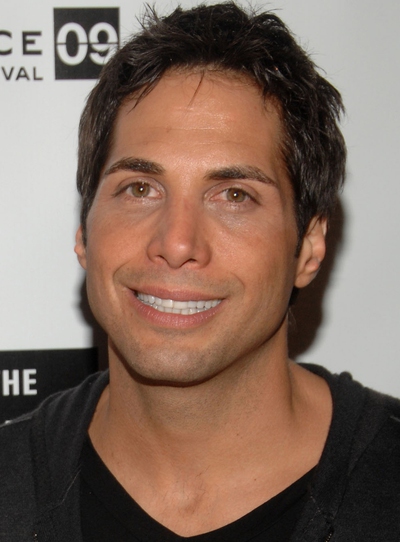

This Jan. 18, 2009 file photo shows Joe Francis at the Sundance Film Festival in Park City, Utah. Francis, the founder of the "Girls Gone Wild" video empire is upping the ante in a legal dispute over a $2 million casino debt with Las Vegas Strip casino mogul Steve Wynn and the Wynn Las Vegas resort, alleging that an effort to criminally prosecute Francis for failure to pay a casino IOU in 2007 amounted to malicious prosecution, defamation, conspiracy and abuse of process.

Sun Coverage

The founder of the "Girls Gone Wild" video empire has upped the ante in a legal dispute over a $2 million casino debt with Las Vegas Strip casino mogul Steve Wynn and the Wynn Las Vegas resort.

A civil lawsuit filed Tuesday in U.S. District Court in Los Angeles alleges that an effort to criminally prosecute soft-porn impresario Joe Francis for failure to pay a casino IOU in 2007 amounted to malicious prosecution, conspiracy, abuse of process and defamation.

Francis' lawyer, David Houston in Reno, said Wednesday he'll seek millions of dollars in general and punitive damages.

The lawsuit seeks unspecified damages from Wynn, top Wynn aide Barbara Conway, and Wynn Resorts LLC. It does not blame prosecutors in the Clark County district attorney's office.

"The prosecutors were duped," Houston told The Associated Press. "They received information from Wynn employees that was basically bogus information."

Wynn Resorts Ltd. spokeswoman Deanna Pettit declined comment.

Houston said he also intends to ask the Nevada Supreme Court to reconsider its order last month requiring Francis to pay Wynn the $2 million remaining in dispute since Francis signed casino markers worth more than $2.5 million in February 2007 at the Las Vegas Strip casino. Some of the debt was repaid.

If that court declines, the lawyer said he'll appeal to the 9th U.S. Circuit Court of Appeals in San Francisco.

The state Supreme Court ruling in a civil appeal in a lawsuit filed by Wynn came a month after a state court judge in Las Vegas dismissed separate criminal theft and bad check charges alleging Francis failed to pay.

Unpaid casino markers, or IOUs, are treated in Nevada like bad checks under a state law that allows prosecutors to file criminal charges and collect a percentage of any settlement.

A Clark County District Court judge ruled that because the casino waited 16 months to redeem the marker, the casino and prosecutors lost their chance to prove Francis committed a felony.

In the new federal lawsuit, Francis, 38, alleges that Wynn employees knew he closed the bank account against which the casino markers were drawn, but that they didn't try to collect from an active account.

Francis was jailed at the time in Reno in a federal case that led to his conviction on tax evasion and jail bribery charges.

He alleges Wynn employees falsely answered "no" to a series of criminal screening questions about whether the dispute stemmed from an extension of credit, involved a post-dated check and whether partial payment was received. A "yes" answer would have sent the case to civil court.

With world-class dining, shopping, spas, golf and entertainment, there's no shortage of things to do at Wynn. The resort’s aquatic acrobatic show, “Le Reve—The Dream,” a creation by Cirque Du Soleil veteran Franco Dragone and Steve Wynn, will leave guests wanting more with its breathtaking performances that conjure an imaginary world. The Wynn Esplanade offers a unique shopping experience with stores including Chanel, Manolo Blahnik, Christian Dior, Oscar de la Renta and many more. Tryst is its signature nightclub, offering a secluded lagoon inside the club and spacious dance floor. Blush, the Wynn’s ultra lounge, draws swanky party-goers. Tryst, Wynn’s signature nightclub, is situated along a private lagoon under a 90-foot waterfall and plays host to some of the world’s most renown DJs.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy