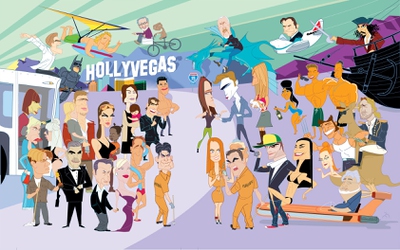

Seven Ft / Special to the Sun

Crews film a scene from the foreign film “The Gambler” at the Plaza in downtown Las Vegas.

Saturday, June 11, 2011 | 2 a.m.

Marilyn Kirkpatrick

Paul Aizley

Sun archives

- Assembly movie bill in danger of hitting cutting room floor (5-12-2011)

- What would lure Hollywood to Las Vegas? (4-20-2011)

- Successful Hollywood movies continue to sell Las Vegas (9-3-2010)

- No lingering 'Hangover' headache (12-19-2009)

- 'Hangover' brings new customers, campaign to Caesars (6-27-2009)

- Commission gives blessing for 80-acre movie compound (6-4-2009)

- Film industry gets top billing at economy planning summit (3-28-2002)

- Hollywood crews are busy filming at old LV cold storage warehouse (2-4-2000)

- Film industry strategy for LV questioned (8-1-1999)

- Residents oppose movie studio plan (1-29-1999)

Related Document

To hear Jason Watkins tell it, a bill to lure movie productions here using tax incentives — and the prospects for further developing a local film industry — went down the drain because of Assemblywoman Marilyn Kirkpatrick, D-North Las Vegas.

Watkins, who is trying to help get two movies made in Nevada, said Kirkpatrick created undue confusion over the issue by introducing a competing measure. The immediate effect, he said, is two movie companies are taking their $10 million productions elsewhere.

Kirkpatrick “will not be re-elected,” Watkins vowed. “I’ll do everything in my power to make that happen.”

However, Frank Woodbeck, a director with the Nevada Economic Development Commission, which was also working on movie incentive legislation, blames Watkins.

“I’m absolutely furious,” Woodbeck said this week. “I worked on that (bill) for 18 months ... For him to say Marilyn did this — he didn’t do a damn thing but screw up the entire thing ... He knows nothing about the business. He got in the way and now he doesn’t want to be blamed for it.”

The truth may be in the eye of the beholder.

The bill would have given movie companies tax credits that could be sold to businesses wanting to lower their tax bills. The incentives were seen as a way to maintain Nevada’s well-known status as a movie/TV-production haven at a time when other states have for years been creating incentives to lure the multimillion-dollar budgets of major movie productions.

Nevada never really needed much incentive before, though, because it enjoys a reputation as a great place to film due, in large part, to the picturesque Strip, its mobbed-up, sexed-up, anything-goes reputation, its virtual no-tax business climate and proximity to Hollywood. When stars come to Vegas, they can stay in first-class resorts.

On the flip side, movies made here benefit Nevada’s tourist-driven economy in many incalculable ways. Not only do film crews spend money and, at times, hire local talent to assist in production, but the publicity from a movie like “Ocean’s Eleven” or “The Hangover” or even the reality show “Real World” can generate enough interest among viewers to turn them into future tourists.

Too tempting to ignore, 40 states now offer film tax incentives while Nevada offers nothing.

So Watkins and others, including Assemblyman Paul Aizley, D-Las Vegas, spent more than a year working on a bill that would have offered productions a 25 percent tax credit and other incentives.

But Kirkpatrick, who has been in the legislative game longer than Aizley, introduced Assembly Bill 506, the Motion Picture Jobs Creation bill, which at first offered the same percent tax credit (though she later lowered it from 25 percent to 15 percent). Kirkpatrick is known as among the hardest-working legislators in Carson City, leading two Assembly committees, Taxation and Government Affairs, and will likely become speaker of the Assembly in 2013. As a senior and respected member of the Assembly, her bill took precedence over Aizley’s.

Watkins alleges Kirkpatrick introduced her bill for one reason: to make sure she could kill it. He believes she is so anti-tax credit, she took control of any attempt to give the film industry a tax credit simply to ensure that it failed. Watkins kept talking to legislators and union members. Eventually, he said he was told that both Gov. Brian Sandoval and Lt. Gov. Brian Krolicki supported the film tax incentive idea. Sandoval’s staff could not be reached for confirmation. Krolicki couldn’t be reached Friday, but Woodbeck acknowledged the lieutenant governor did support a tax-credit bill, though not to the degree that Watkins wanted.

Kirkpatrick admitted the bill didn’t really get much attention for a while, because lawmakers were scrambling to figure out how to put together state services during a time when the poor economy demanded either more taxes, more cutbacks or both. Reached after the session, Kirkpatrick said tax abatement bills didn’t do well during the session. “We were scraping, you know, to find even $10,000,” she said.

And the film tax bill didn’t get much attention until the end, she added, because of the focus on the budget. “We had to determine where the budget was before we could allow for any abatements,” she said.

She disagreed with Watkins and his push for a 25 percent credit, adding that she had no idea who Watkins was before this session and still “wouldn’t know who he was if he walked up to me.” Though her original bill supported 25 percent, she changed it to 15 percent, saying the state would have given away more money than it collected in taxes at the higher rate. Her enthusiasm for film incentives, she also said, was tempered by a report in June from the Tax Foundation showing some states cutting back on tax credits. The report concludes that “film tax credits fail to live up to their promises to encourage economic growth overall and to raise tax revenue.”

Noting that states gave $6 billion in film tax incentives since the 1990s, the report says eight states have recently killed or decided not to fund film tax credit programs. Nine are capping or reducing credits, or seeking to eliminate them altogether.

Some states, however, are adding to the mix. Utah expanded its credit program; Virginia added a film tax credit and Wyoming extended its program.

Reports also exist trumpeting the success of film tax credits. Watkins cited one from Louisiana. The report doesn’t demonstrate an immediate one-to-one payback — a $1 million tax credit, for instance, doesn’t immediately reap $1 million in tax collections. But the state’s 30 percent incentive is creating a film industry infrastructure, the report says, so that “services that once had to be performed in Los Angeles can now be secured in Shreveport.”

That’s the long-term positive jobs growth Watkins envisioned for Nevada.

Kirkpatrick said she wants that too — and it might have begun if not for Watkins’ “rogue” amendment.

Days after the session, Watkins pulled out a color photocopy of his version of AB506. It changed Kirkpatrick’s bill in small but important ways. For instance, it gave the governor the right to increase incentives to 25 percent, when Kirkpatrick wanted it limited to 15 percent. It also created an advisory council, which Kirkpatrick saw as an unnecessary layer of bureaucracy.

Here’s where things get murky. Watkins thought his version would be cast aside, having been told Kirkpatrick would kill any version but her own. So he was astonished on Memorial Day when members of the Ways and Means Committee were talking about his version of AB506, not Kirkpatrick’s. “Somehow my amendment got into their hands,” and Watkins thought it might get passed because no one realized it wasn’t Kirkpatrick’s.

The committee stopped debate, however, because his version included per-diem payments to advisory council members. That means money. So they wanted Woodbeck’s agency to figure out how much it would cost.

That moved the bill out of the committee’s hands. The Legislature continued at breakneck speed, as it does the last week of every session. The bill never came back. It died.

When Kirkpatrick realized what happened, Dan’l Cook, president of the International Alliance of Theatrical Stage Employees Local 720, said he watched her “shake” with anger.

“I thought we were golden” with AB506, said Cook, whose union has about 1,675 members. “It was a jaw-dropper to sit and watch that whole thing get tanked.”

He added his union had nothing to do with Watkins’ efforts, although he appreciated Watkins’ amendment because of the larger tax incentive. That said, Cook would have been more than happy to see Kirkpatrick’s bill become law, then “played with it later” in the future.

Now, he said, it will be at least two years, until the next legislative session, before the incentives will be reconsidered.

Watkins, meanwhile, blames Kirkpatrick, figuring she had put the whole fiasco into motion by somehow making sure his version, not hers, got to Ways and Means. She knew, he says in hindsight, that the committee would figure it out and the bill would die for lack of time.

He’s vowed to oppose her re-election.

“Bring it,” Kirkpatrick said.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy