Wednesday, Jan. 12, 2011 | 2 a.m.

Sun archives

- Goodman taking budget case to state leaders, floats tax hike (1-6-2011)

- Brian Sandoval: Let local officials raise taxes (10-19-2010)

- Report: Las Vegas home price increase lags other cities (6-29-2010)

- Proven again: Home rule a lost cause (7-28-2009)

- Declining property tax revenue snags School District budget (4-3-2009)

- Collins: Cave ceiling on property taxes (4-1-2009)

Anyone who bought property before the boom and has held onto it has some idea how Clark County leaders feel as they go about building a budget for the upcoming fiscal year: A key piece of their portfolio — property tax revenue — is worth far less than it was 12 months ago.

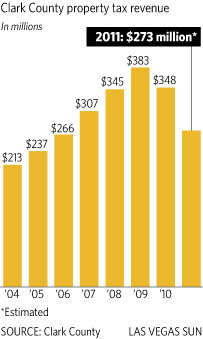

Property tax revenue, which makes up a third of the county’s general fund, is expected to fall to 2006 levels at best. County officials are estimating a $75 million drop, a significant portion of the county’s $1.1 billion budget.

If there is a silver lining, it’s that this was expected given property values have been sliding for years.

Home values have dropped almost 60 percent from their mid-2000s peak, although they appear to have stabilized somewhat (assessments are expected to fall only a percentage point or two this year.) The value of commercial properties and vacant land have nose-dived, 30 percent and 50 percent respectively over the past year.

“There’s no demand for development or new construction,” said Rocky Steele, Clark County assistant director of assessment services.

A 2005 property tax cap, put in place during the boom, delayed how closely property tax revenue tracked the decline in property values. But no more.

(The statute requires property owners to pay taxes on the lower of either the actual value or the capped value. Actual values have fallen below capped values.)

The decline in county property tax revenue could grow higher than $75 million if a large number of people contest their assessments, as was the case last year when a record 8,297 property owners argued for lower tax bills. The county Equalization Board reduced assessments for 2,600 property owners, costing the county $6 million in assessed value.

Property taxes aren’t the only problem for county number-crunchers.

The state, struggling with its own budget deficit, is targeting local governments to close the gap. The county is dealing with the increased needs of a larger population in a down economy.

County officials said dipping property tax revenue is part of a triple budget hit, which also includes state government take-aways and increased demand for services.

Gov. Brian Sandoval has proposed balancing the state budget, in part, on the backs of local governments. Sources say Sandoval is considering taking 5 cents for every $100 of assessed value from property tax revenue (a $70 million to $80 million hit), while pushing additional unfunded mandates onto the county or taking away a bigger share of federal funding.

There’s good reason for county officials’ concerns. During the last Legislative session, the state siphoned 4 cents for every $100 of assessed value in property tax revenue from the county and raided a municipal transportation fund. Clark County officials estimate the swipes cost it about $180 million over two years. County officials have little power to raise taxes because they don’t have home rule.

So although falling tax bills are good news for homeowners, they’ll likely result in fewer county services, Clark County Manager Don Burnette said. The county provides fire protection, builds and maintains roads and parks, oversees the justice system and provides many social services.

Burnette was reluctant to talk about specific cutbacks being contemplated, but he noted that over the past year Clark County has laid off more than 200 workers and another 1,400 positions are being held vacant.

“All that’s really left by way of reducing costs is salaries and benefits, and people equal services,” he said.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy