LEILA NAVIDI / LAS VEGAS SUN file

Juanita Mendoza, left, and Lisa Scalzo hang out at Blush, a nightclub at Wynn Las Vegas. The lucrative party atmosphere that drives beverage profits compelled Wynn Resorts’ decision to build an additional nightclub and daytime beach club at Encore’s Strip entrance.

Monday, March 1, 2010 | 2 a.m.

Sun Archives

Beyond the Sun

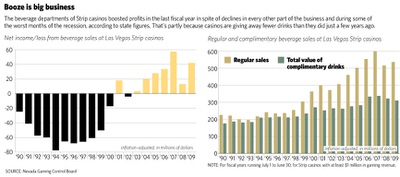

Booze was still big business on the Strip last year, with visitors drinking their way through the recession even as they spent less on hotel rooms, gambling and eating, state figures show.

The beverage departments of the Strip’s 38 largest casinos reported increases in revenue and profit amid the worst year for the casino business on record, according to the Gaming Control Board’s annual review of Nevada casinos’ financial performance.

But one of the reasons for the booze boost is something that veteran visitors have been complaining about over the past several years — fewer free drinks.

The retail value of comped drinks as reported by Strip casino beverage departments was $310.7 million in fiscal year 2009 compared with $317.8 million a year earlier, a decline of 2 percent.

In years past a gambler could drink for free all night, but some now complain that cocktail servers don’t make the rounds on the casino floor as frequently as they used to — which is not surprising given casinos are operating with fewer cocktail servers.

So if you’re a thirsty casino customer, “the first drink might be comped but the next drink you’re paying for,” says Clyde Burney, vice president of beer distribution for Southern Wine & Spirits.

And people want their comfort liquids in Las Vegas, so they pony up for them, even in a recession.

Or, as Cy Waits, managing partner of the Tryst and XS nightclubs at Wynn Las Vegas and Encore, puts it: “People want to go out and drink in good times and in bad times.”

Nightclubs helped fuel the beverage profits — which in turn spurred Wynn’s decision to build an additional nightclub and daytime beach club for $67 million at Encore’s Strip entrance overlooking Las Vegas Boulevard. They’re to open in May and began hiring 400 employees this weekend.

The clubs build on a “very profitable sector of the market, the alcoholic beverage,” Steve Wynn said during Wynn Resorts’ fourth-quarter earnings conference call Thursday. “The margins are fabulous. You know we have 65 percent profit margins in these departments, better than blackjack in many respects.”

The busy nightclub scene has had a spillover effect as customers spend money gambling and in casino restaurants and bars before and after partying in clubs, operators say.

Alongside the proliferation of large, elaborate nightclubs, casinos have created a new revenue source by holding daytime events centered on their pools, which extend the party atmosphere around the clock.

Even the mundane act of consuming alcohol has gone upscale.

Bellagio began pouring wine and cocktails for gamblers table-side, and it trained servers to mix more complicated drinks for customers in its clubs rather than just setting out a bottle of vodka and fruit juice. And servers at Rio’s Voodoo Lounge mix drinks table-side using custom-flavored alcohol infusions. Such drinks cost more, but for the new generation of bar and club consumers, drinking and partying — rather than gambling — has become the main event.

“The big customers who used to come a couple of years ago have gone away somewhat, but we still have the middle class, and they’re not necessarily gamblers,” Waits said.

On the Strip, where the bulk of the state’s alcohol is consumed, beverage department revenue rose 5 percent last fiscal year. In the same period, income in the gambling, rooms and food departments fell 32 percent, 23 percent and 12 percent, respectively.

Although many casino visitors have given up or reduced spending on expensive dinners or big betting, alcoholic drinks are a relatively “low-ticket item” that “people aren’t cutting out,” said Frank Streshley, chief of the Control Board’s tax and license division.

This despite alcohol having a higher markup than just about anything else on the menu.

At the Palms, casino bar sales were a bright spot in an otherwise lousy year, owner George Maloof said. He booked more entertainment acts, including concerts at his Pearl venue, and has been able to sell more drinks than usual during such events, he says.

Although casinos are making more profit on drinks than ever before, beverage sales are still a small part of gambling industry economy, representing 6 percent of the total revenue generated in Strip casinos, according to the state’s report. It has only grown slightly from 2000, when it was 5 percent of the total and gambling was 46 percent of total revenue. Gambling represented only 39 percent of revenue generated in Strip casinos in the 2009 fiscal year.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy