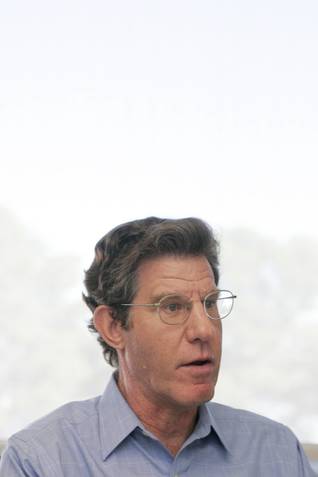

Clifford Winston, a senior fellow in economic studies at the Brookings Institution, says economists disagree less than most people probably think they do, and all recognize the positive power of market forces.

Saturday, Oct. 10, 2009 | 2 a.m.

Sun Archives

- More Nevadans will need help as economic storm worsens (9-27-2009)

- Six questions for Robert Lang (9-10-2009)

- The potential for prosperity in Las Vegas (9-9-2009)

- Experts: Despite downturn, Las Vegas has hope (9-8-2009)

- Washington think tank with ideas for the West starts UNLV partnership (9-8-2009)

- UNLV forms partnership with Brookings Institution (9-2-2009)

Beyond the Sun

Anyone who thinks the Brookings Institution is a lefty think tank need only talk to Clifford Winston, a senior fellow in economic studies. Winston was in town this week to deliver a lecture at Brookings-partner UNLV. He argued that government intervention and regulation rarely make economic sense.

You came here to address whether the Great Recession should change our view of government intervention in the economy. Evidently it hasn’t changed your view much.

Yes, I would say, let’s not overdo it. Yes, there were certainly problems with the behavior of markets, especially in one particular area, but let’s not jump to the wrong conclusions. More transparency in mortgages is called for. But the housing industry itself has an incentive to clean itself up. Reputation matters.

What about the financial industry?

Again, Wall Street is taking a hit. This is not good for them. And they know it. They’re going to work on their reputation. There will be industry incentives to work on transparency. The rating agencies that measure the risk of financial instruments seem to have their own cozy oligopoly and were uniformly ineffective, and maybe even had conflicts and incentives not to point things out.

Also, with the investment banks, we need more transparency: How much leverage do you really have? How exposed are you?

What is the public’s biggest misconception of the economy?

The robustness. The dynamism of our economy. People don’t realize that what makes us different from any other country in the world is that we’re not afraid to change.

America wasn’t very dynamic during the Great Depression. What has changed?

We were a different country, in terms of sophistication of understanding how to respond to economic shocks. Cutting the money supply, restricting trade — those are obvious things we look back now in horror that we did in the ’30s.

What is the greatest misconception about economists?

That they disagree more than they do. There are differences, like to what extent markets work and when government intervention makes sense, but I think all of us agree that the material well-being of this country is largely attributable to market forces and their dynamic effects.

As an economist, what do you think of Las Vegas, a city based on risk and chance?

My vision of Las Vegas isn’t shaped as an economist. It’s shaped by my being a student of “The Godfather.”

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy