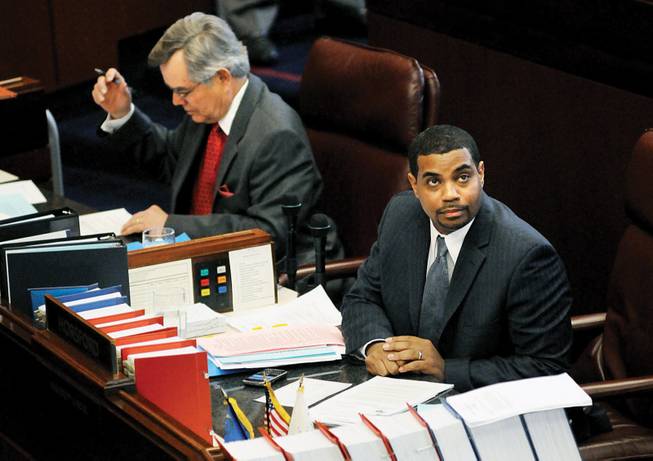

KEVIN CLIFFORD / SPECIAL TO THE SUN

Majority Leader Steven Horsford, D-Las Vegas, shown during a Senate floor session April 8, says, “We need to broaden the tax base, whether it’s a net profit tax or something else where all businesses participate reasonably.” He says the tax would not go into effect until 2011, when, it is hoped, the economy will be stronger.

Tuesday, May 5, 2009 | 2 a.m.

Reader poll

Sun Archives

- A job you don't want: Projecting the state's revenue now (5-2-2009)

- State falls $550 million short in funding governor's budget (5-1-2009)

- In Henderson, Gibbons reiterates his anti-tax stance (5-1-2009)

- To be clear, Gibbons is against tax increases (5-1-2009)

- Gibbons to propose more salary cuts, says he'll veto tax hikes (4-30-2009)

- Lawmakers eye county dough (4-30-2009)

Sun Coverage

Sun Blogs

Senate Majority Leader Steven Horsford, D-Las Vegas, said he is still committed to broadening Nevada’s tax base this session, including a corporate income tax that would be passed this year but wouldn’t take effect until after the 2011 session.

The need for fundamental tax reform was widely discussed by business and government leaders in the months leading up to the legislative session. But the idea has received scant support from legislative leaders in recent weeks, with Democratic Assembly Speaker Barbara Buckley and Republican Senate Minority Leader Bill Raggio opposing the idea. Horsford now hopes to revive it.

He said other legislative leaders are focusing on the current shortfall. Though he didn’t name them, he meant the Republican colleagues he has courted assiduously to give the expected $800 million or so tax increase a bipartisan stamp.

But he also could have been obliquely referring to Buckley. The Las Vegan, thought to be a candidate in the 2010 race for governor, has taken a more minimalist approach to changes in Nevada’s tax system, preferring to increase existing taxes rather than consider new ones.

Although Horsford agreed the short-term shortfall needs to be addressed, he said the state should use the current crisis to change the tax structure.

“Those who will be here two years from now, we’re thinking ahead,” said Horsford, who is serving his first term as leader after guiding Senate Democrats to the majority with two big victories last fall. “The stimulus is one shot. There’s likely to be a gap in revenue. We must address the fundamentals of our tax structure.”

He said increasing the existing modified business tax, which is a payroll tax, would not broaden the tax base.

Instead, he wants the Legislature to increase existing taxes to meet short-term needs and to put in place the new tax, though the state wouldn’t collect revenue on it for now.

Then the Legislature would form a technical committee to meet during the interim to recommend rates for the tax and how to implement it. If the tax were passed this year with a two-thirds majority, the Legislature could start it in 2011 if were approved by a simple majority rather than having to meet the two-thirds requirement again.

“We need to broaden the tax base, whether it’s a net profit tax or something else where all businesses participate reasonably,” Horsford said.

Horsford has rallied his caucus around the idea of passing a broad-based tax now, but it’s not clear whether he has support elsewhere in the building, or even how hard he is pushing it with the dozen or so legislators of both houses and both parties who are working on a final deal.

Assemblywoman Sheila Leslie, D-Reno, one of the dozen in that so-called “core group,” said she would support a corporate income tax — particularly if it went into effect in 2011 — when the economy has rebounded.

“When the economy is good, a broad-based tax gets large, out-of-state corporations who make millions to contribute to our tax base,” said Leslie, a top lieutenant of Buckley’s but also known as one of the Legislature’s most liberal members.

Horsford’s comments came at the end of a tumultuous day of closed-door meetings at the Legislature as lawmakers continue to confront the worst fiscal crisis in the state’s history.

Last week the state’s official fiscal forecaster, as well as the budget director, said legislators would have to find $900 million just to fund Gov. Jim Gibbons’ budget, which was viewed as draconian and unworkable by legislators in both parties. Although the deficit will be offset somewhat by federal stimulus dollars, the budget hole will still require a painful mixture of spending cuts and tax increases.

Asked where they are on a tax package, Leslie said, “We haven’t settled yet.”

Asked if the tax hike would be greater than $836 million, which was the amount raised during the difficult 2003 session, she said, “Republicans don’t want to go that high raising taxes, so we’re looking at other ways to raise revenues.”

Many observers believe Buckley is being pragmatic in courting Republican votes, but also wants to avoid being tagged for voting for what would be the largest tax increase in Nevada history.

Leslie said the differences between Senate and Assembly Democrats are “very small.”

Legislators began the work of cutting last night. State workers and higher education employees will take a 4.6 percent pay cut by being forced to take one furlough day a month, and teachers will be asked to take a 4 percent decrease.

A joint Assembly and Senate committee meeting Monday night approved the measure unanimously after leadership from both parties spent hours hammering out a deal.

Gibbons had recommended a 6 percent cut for state workers, teachers and higher education employees to make up for the state’s budget shortfall, in addition to a 36 percent cut to higher education spending.

Last week he said he would recommend a higher pay cut to meet a growing budget gap.

Legislative staff said they could not cut more than 4 percent from higher education and teachers because of federal stimulus dollars that come with the condition that the state maintain certain funding for education.

“This is one of the hardest decisions to make when closing the budget,” Buckley said. “It’s fair to say, no legislature wants to cut any of those funds. Unfortunately, revenue is 44 percent below what we need to fund current levels of funding.”

Legislators said the idea to furlough state workers one day a month came from the state workers union. State Budget Director Andrew Clinger said one furlough day a month would equal a 4.6 percent cut.

Raggio, the long-serving Reno Republican, said, “This motion comes as a result of extensive discussions ... This is not an easy decision.”

Of solace to state workers is this: If the economy improves, the Legislature will restore salaries.

The Legislature sets pay raises or reductions for state employees.

And, although legislators ultimately control the purse strings of school districts, they can only make recommendations about what school boards or the regents do with the money allocated.

If school districts don’t reach an agreement with local unions to follow the Legislature’s lead on pay cuts, the budget reductions will have to come from programs or some other area, which could devolve into a deeply divisive process.

“This stings,” said Lynn Warne, president of the Nevada State Education Association. But, she added, “these are very difficult times. I believe they’ve done all they can do.”

The joint money committee also decided to suspend merit pay increases and longevity pay for state employees.

This is a key week for the Legislature as it closes many of the remaining large budget issues. The core group of legislators has been meeting frequently to arrive at a consensus on what to cut and what taxes to increase.

Buckley said after today’s meeting that no agreement had been reached on anything other than salaries.

Horsford released a solemn statement: “This is a very tough time and a tough job. But it is what we were sent here to do.”

Coolican reported from Las Vegas.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy