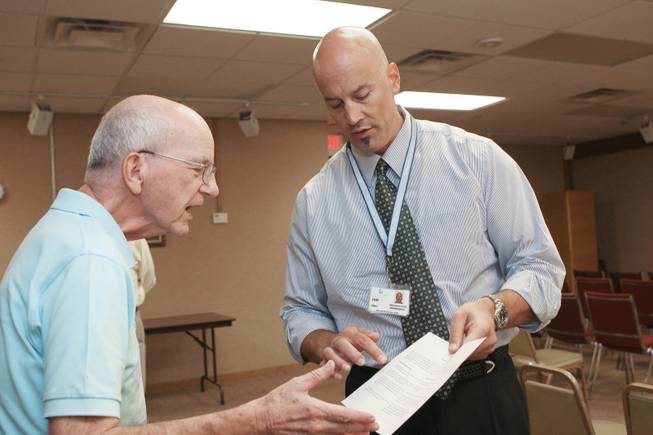

Mona Shield Payne / Special to the Home News

Stan Hawkes, left, discusses the proposed Boulder City Hospital tax with CEO/Administrator Tom Maher of Boulder City Hospital during the open-forum meeting held at the Boulder City Senior Center.

Thursday, Oct. 2, 2008 | midnight

Boulder City Hospital officials are planning for the next year without income from a proposed tax voters will decide on next month.

Chief Executive Tom Maher said Sept. 30 he thinks the November ballot initiative, which asks for a 15 cents per $100 assessed home value property tax, will fail. If it passed, the tax would raise about $750,000 a year for the hospital, income crucial to the hospital's ability to provide services, hospital officials say.

Maher was at a forum at the Senior Center of Boulder City to talk about the proposal when he made the comment to the Boulder City News. The town hall meeting drew only two people, even though hospital officials say local seniors have the most to lose if the hospital closes or cuts services.

Craig Bailey, the hospital's director of business development, had anticipated a larger crowd after gauging interest last month with Lori DeCreny, the center's director.

"As a group, they have the most at stake," he said. "They're our highest consumer based on age."

Maher said he figured most people were too overwhelmed with the national economy and political climate to concern themselves with the initiative.

Charles Harrison, the chief financial officer, agreed.

"There's too much distracting them to pay attention to this, but they should be," he said.

Maher said he's working with the hospital's consulting firm, Whipfli, to determine which services are profitable and which aren't, and which contracts with insurance companies could be canceled.

He said he hopes to know each program's profits and losses by the end of the year to work into next year's strategic plan.

Maher has said if the hospital doesn't raise the anticipated $750,000, it won't be able to afford free community health fairs, which include bone density and cholesterol screenings.

Without the money, the hospital also might have to close its intensive care unit and discontinue all emergency surgeries, he said.

If the tax doesn't pass this year, Maher said, he would likely bring the question to voters at the next general election. He has no plans in the meantime to shop the independent hospital to merge with a larger corporation, he said.

While the hospital forum drew only two, others at the Senior Center played cards or finished lunch. Most seemed to have already made up their minds about their vote.

A group of eight ladies at a poker table who declined to provide their names said they wouldn't vote for the tax because it was too high. It is estimated to cost about $158 a year for a home valued at $300,000.

They said they didn't attend the information session because it conflicted with their game.

In the dining hall, another three women said they support the tax, but they didn't attend the meeting because they don't often get to visit with one another.

Sandra Shook heard the hospital's presentation at a Grace Community Church breakfast earlier this year. She said she's been taken to the emergency room before, and she appreciates being able to have her blood drawn "around the corner."

Maher said he had looked forward to the meeting so he could assure people the hospital wouldn't raise the tax amount after it was approved, as some had suggested in a previous forum.

He said he has met with City Attorney Dave Olsen and City Manager Vicki Mayes to develop a way to prevent future hospital officials from increasing the tax without voter approval.

Cassie Tomlin can be reached at 948-2073 or [email protected].

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy