Gabriela Martinez, in the home she is being forced to move from because of foreclosure, was losing two others as well. She says she was contacted by companies that offered to help her, for a fee.

Friday, July 18, 2008 | 2 a.m.

WHAT EXPERTS ADVISE

Government officials and consumer advocates are warning homeowners to avoid so-called foreclosure rescue consultants who promise to save their homes. An attorney for the National Consumer Law Center said Housing and Urban Development-certified counselors can negotiate with lenders to work out a payment plan for those facing foreclosure.

Jeffery Brown offered a lifeline to homeowners swamped by the rising tide of foreclosures.

For an upfront fee, Brown’s DB Financial Group would agree to negotiate with lenders on behalf of those who had fallen behind on their mortgage payments. If he couldn’t work out a deal, he promised, he would return the cash.

But Brown only added to the financial burden of his debt-laden clients. This year, two Sacramento couples told the Nevada attorney general’s office that after taking their money, Brown didn’t contact their lenders and refused to refund their $995 payments.

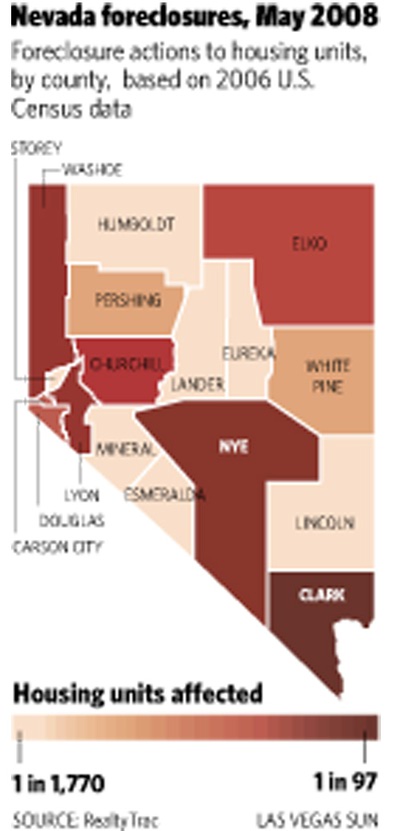

The foreclosure crisis has created a growth industry in bailout schemes. Assistant Chief Deputy Attorney General John Kelleher estimates dozens of “foreclosure consultants” have set up shop in the Las Vegas Valley, where foreclosure rates are among the highest in the nation. More are offering their services over the Internet.

Brown is among the first consultants the attorney general’s new mortgage fraud task force has charged. Investigators said Brown would sift through assessor records looking for people who had fallen behind in their mortgage payments and then contact them by mail.

“The scammers will go with the flow. It’s kind of like a virus,” Kelleher said. “We’re only seeing the beginning now.”

In March, about a dozen investigators from the attorney general’s office searched Brown’s high-rent Horizon Ridge Parkway offices.

Brown wasn’t there. He had purchased a plane ticket to the Philippines and is believed to have boarded a flight shortly after the search. Airline ticket agents told investigators he appeared willing to pay almost anything to board the next flight.

State legislators gave prosecutors a weapon to use against foreclosure profiteers when they passed a law last year barring foreclosure consultants from taking money upfront and making it easier to prosecute mortgage fraud.

But the law hasn’t changed the way some foreclosure consultants operate.

Gabriela Martinez, who owns three homes in foreclosure, said she was contacted recently by a local company that offered to help for an upfront fee of $1,350. Another consultant contacted her this year promising to intervene with her lender for $500, payable in advance.

A business on East Tropicana Avenue collects a $50 fee for a consultation and another $1,500 to negotiate with a lender on behalf of a homeowner. Half of the fee is due before services are provided.

Government officials and consumer advocates are warning homeowners to avoid foreclosure rescue consultants who promise to save their homes.

Lauren Saunders, an attorney for the National Consumer Law Center in Washington, D.C., said Housing and Urban Development Department-certified counselors can negotiate with lenders to work out payment plans for those facing foreclosure. They provide services at no cost to homeowners, she said.

At a foreclosure prevention event at Cashman Center last month, representatives of the attorney general’s office heard a number of complaints about foreclosure consultants.

Carla Davis, a mother of two young children, reported that she had paid $700 upfront to a business that promised to help her avoid foreclosure. Davis said the company never contacted her lender.

The search of Brown’s offices yielded a cache of information. Authorities say they uncovered a larger mortgage fraud scheme involving Brown and his girlfriend, Cindy Birkland, with whom Brown shared a Henderson home purchased for $1.8 million in 2005.

The two are accused in a criminal complaint of lying on loan applications, forging documents to skim cash from loan deals and, along with two associates, Bryan Sears and Claudia Koziol, pocketing nearly $100,000 in phony construction loan proceeds.

Brown remains at large. Birkland, Sears and Koziol face more than 30 charges of theft, forgery and racketeering and are out on bail. Officers handcuffed Birkland outside a restaurant where she had attended a talk by Metro Police on mortgage fraud.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy