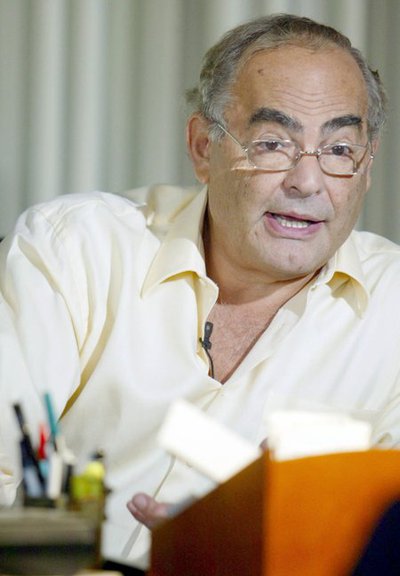

Sun file photo

MGM Mirage announced Monday that it will sell Treasure Island to former Frontier hotel owner Phil Ruffin. MGM Mirage has owned Treasure Island since May 2000.

Tuesday, Dec. 16, 2008 | 2 a.m.

Sun Archives

- MGM Mirage to sell Treasure Island (12-15-2008)

Beyond the Sun

For some casino operators, this downturn is a fight for survival.

For a select group of entrepreneurs, it’s the chance of a lifetime.

One of them, Phil Ruffin, got his chance Monday, when MGM Mirage announced it would sell Ruffin the company’s Treasure Island for $775 million.

It’s a deal that would have been unlikely in recent years, when Treasure Island, which generated record profits last year, benefited from a major makeover.

But these are unprecedented times.

MGM Mirage needs the cash and Ruffin, a manufacturing magnate from Kansas who parlayed a well-timed sale of the New Frontier into a $1.2 billion fortune, has the cash.

Treasure Island, like most resorts on the Strip, wasn’t ostensibly for sale.

But Ruffin, a friend of MGM Mirage’s former chief executive, Terry Lanni, saw an opening and pounced three weeks ago with an offer: $500 million in cash and $275 million in the form of a short-term note at 10 percent interest, with $100 million due 175 days from closing and $175 million due 24 months from closing.

MGM Mirage will act as the banker and carry the note, avoiding the public markets. The sale is expected to close in the second quarter of 2009.

“This property was not for sale. I pestered them and pestered them until they finally gave in,” Ruffin said.

The company will use the cash to pay down debt and help fund CityCenter, MGM Mirage Chief Executive Jim Murren said.

It will alleviate some, but not all, of the company’s concerns.

MGM Mirage has $1.3 billion in notes due next year and another $1.2 billion in loans coming due in 2010. The company still needs $1.2 billion in financing for CityCenter, the resort complex it will open next year with joint venture partner Dubai World.

Some analysts say the deal will give MGM Mirage a cash cushion of several hundred million dollars if the company is successful in raising additional funds for CityCenter and selling a significant chunk of CityCenter’s condominiums — both uncertainties in this economy.

Major casino operators loaded up on debt when it was cheap and have been forced to find creative ways to pay it down now that earnings have fallen by 20 percent or more and capital to refinance that debt is scarce.

This presents a unique opportunity for entrepreneurs to pick off properties that wouldn’t normally be available.

MGM Mirage is getting a lot of calls from prospective buyers.

“The message is that there’s a market for high-quality assets that are well-run” and are now more affordable, Murren said.

And yet, few buyers have the cash needed to make such deals happen.

“I wouldn’t rule out other asset transactions, though they might not come from us,” he said.

Experts also said this sale is unique and doesn’t necessarily signal the start of heavy wheeling and dealing on the Strip. Deutsche Bank stock analyst Bill Lerner said it’s more likely that MGM would sell properties outside Las Vegas or vacant land it owns on the Strip.

“There’s probably a handful of people in the world” who are willing and able to obtain a state gaming license, who have some familiarity with the industry and are eager to put up hundreds of millions of dollars in cash, said Carlton Geer, executive vice president of CB Richard Ellis’ gaming division.

Of major gaming companies, only Penn National Gaming appears willing and able to go bargain-hunting in Las Vegas, analysts say.

The Pennsylvania-based company showed some interest in the Strip in years past, though some say prices might still be too high. Penn National avoided the predicament of some of its competitors when a leveraged buyout fell through this year, leaving the company flush with cash.

Company officials could not be reached for comment.

Besides Ruffin, there’s another ex-casino operator sitting on at least a billion dollars: Jack Binion sold his Horseshoe casino empire to Harrah’s Entertainment for $1.5 billion in 2004 and has since invested in small, nongaming deals.

Like Penn National, Binion is unlikely to pursue a major purchase without access to Wall Street capital, experts say.

“You’d still need the credit markets to loosen significantly in order to see a notable number of transactions,” Lerner said.

Other potential buyers, including casino newbies, are looking to pick up properties on the cheap. But Geer, who receives many such cold calls, says casinos are still too expensive for their liking.

Typically, buyers will finance at least 90 percent of a property’s value.

That makes the Treasure Island deal a throwback to the mob’s heyday in Las Vegas, when Wall Street financing wasn’t available and cash deals, or transactions that involved some cash and private financing from sellers, were common, Las Vegas resort broker David Atwell said.

Experts say it’s difficult to draw broad conclusions from this deal because each casino transaction is unique.

Casinos are difficult to value in bust cycles just as in boom times, Geer said.

Perhaps most important, given the expense involved in buying and maintaining them, is the availability of financing.

By one historical measure, the Treasure Island deal is a bargain — only $345 million more than Steve Wynn spent to build the property. (MGM Grand acquired the property as part of the Mirage Resorts sale from Wynn in 2000.)

The starting rate for a Strip casino is about a billion dollars, while a luxury resort might cost two to three times as much.

Casinos sold for more than 10 times their annual earnings during the credit boom. MGM Mirage will sell Treasure Island for about seven times what the property earned over the past 12 months — a multiple more in line with transactions before 2000.

The price is fair, analysts say, given that reasonably priced financing is unavailable, the economy is depressed and the future is unpredictable.

“I think Ruffin will do well on this transaction, but he’s buying at an uncertain time,” Geer said.

Treasure Island has evolved along with Las Vegas into one of MGM Mirage’s most prized hotels. The company has put more than $100 million into the property in the past four years, replacing a family-friendly pirate theme with upgraded attractions with a youthful, adult vibe, including a pirate show with scantily clad “sirens.”

The makeover worked, though Treasure Island has been hard hit in this downturn along with the rest of the Strip. Earnings rose 19 percent last year but fell 18 percent from January through September.

The upgrades mean very little work for the buyer, and Murren calls Treasure Island General Manager Tom Mikulich “one of the best” in the business.

Ruffin is a master of timing who sold the New Frontier to New York and Israeli developers last year before the credit crunch. The site has remained vacant during the market turmoil.

He is expected to generate enough cash to pay down the notes, putting him in the enviable position of becoming debt-free — a rarity in this business.

“I probably didn’t buy at the bottom of the market,” Ruffin said. “But I’m close.”

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy