Wednesday, Dec. 10, 2008 | 2 a.m.

Sun Archives

- Lawmakers reach agreement on $340 million deal (12-8-2008)

- Governor still promising to veto tax increases (12-5-2008)

- Mining industry asked to prepay tax in budget deal (12-4-2008)

- State tax collections expected to take 9.1 percent hit (12-1-2008)

A U.S. Supreme Court justice once famously admitted that defining obscenity is an impossible task, but, he added, “I know it when I see it.”

The same could be said in Nevada today, but it wouldn’t be applied to deviant sexual behavior. No, what passes for obscenity to certain Nevadans is a tax increase.

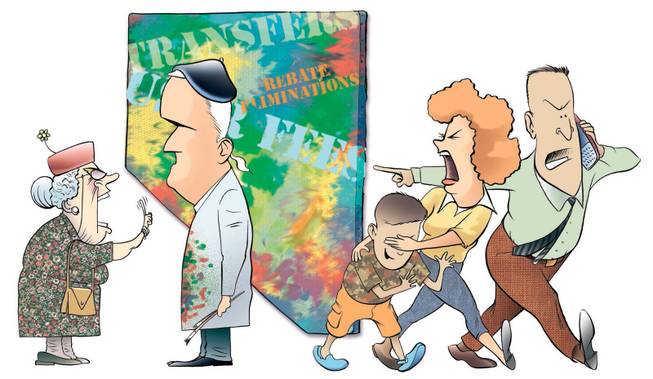

Which explains why Gov. Jim Gibbons and legislators — Democrats and Republicans alike — are going through linguistic contortions to define the steps they are taking to balance the budget as “revenue enhancements,” or “redirection,” or “rebate eliminations.” Just not tax increases.

Most definitely, not tax increases.

Will it work? Or will Nevadans, as Supreme Court Justice Potter Stewart wrote in an opinion in 1964, know this particular obscenity when they see it?

The latest round of euphemistic juggling came Monday, when the Legislature passed two measures under the “revenue adjustment” header.

The first nontax scheme was this: Legislation reduced the amount of money retailers could keep for administering sales, liquor and cigarette tax collections. The benefit to state coffers is about $2.5 million.

State government gets more money. Business gets less. But, it is not a tax hike.

So said Chuck Muth, the conservative activist, pundit and local lifeline to national anti-tax crusader Grover Norquist, the national figure who has advocated for a “starve the beast” approach to government.

During Monday’s session, Muth, who challenges political candidates to sign a pledge not to raise taxes, sent out a news release headlined: “Sales tax proposal NOT a tax hike.” Instead, he compared it to a pay cut for the businesses that had been administering the tax collections.

The second maneuver took a 1 percent tax on car rentals and sent it to the state. The state had been allowing rental companies to keep the money to offset vehicle registration fees.

The industry spoke up.

“I said, ‘They’re taking money away from us.’ It was a tax increase,” said Bob Ostrovsky, a lobbyist for the rental car industry.

The Legislature and governor did this last session too.

“I have lost that argument twice,” Ostrovsky noted. “The governor is trying to keep his promise not to raise taxes. The Legislature really doesn’t want to raise taxes. This gives them at least an argument to say, ‘No, we didn’t raise taxes.’ ”

Gibbons on Tuesday said neither measure was a tax increase.

“It won’t affect the consumer,” he said.

Carole Vilardo, of the Nevada Taxpayers Association, agreed.

“They redirected revenue sources,” she said.

The linguistic game is a constantly evolving one.

The $160 million loan the legislators and governor agreed to? In speaking of it, state officials had been hammering home the more palatable term, “line of credit.”

Yet even for Gibbons, higher fees can be massaged into palatability.

The governor, a signer of Muth’s “no new tax pledge,” also said Monday that fee increases are off the table. Except, he said, those fees that fit into a memorandum outlining the governor’s position, which was sent to state government during the 2007 legislative session.

That memo states that most fees are off the table. “However, fee increases or assessments that do not fall on individual taxpayers, but are borne by an industry with the consent of that industry may pass muster if there is a strong and substantial justification for the fee or assessment.”

Phew. Some fees can be increased if the industry wants them and it’s important enough.

Vilardo said the semantic game has been played for decades, and will be key to what happens during the 2009 legislative session.

“Taxes are in the eye of the beholder. If I don’t like something, it’s a burden on me, I’m going to identify it as a tax,” she said. “That’s the ultimate endgame with taxes. How you sell it to somebody, or you get people mad at it. It’s how you phrase it.”

Take, for example, the special session in June, when the Legislature convened to address an earlier budget shortfall.

A judge had thrown out decades of state practice that required casinos to pay sales tax on meals comped to guests and workers. The state worried that it could cost more than $100 million to refund this money. So a bill draft was submitted clarifying the intent of the law.

Suddenly, though, a suggestion was floating through the hall that the law could be construed as a tax increase.

Muth descended into the legislative building. (Asked why he had dashed the Capitol, he said, “I heard there might be a tax increase.”)

Branded with the scarlet “T,” the measure lost Gibbons’ support. He suggested he might have to veto it, if it passed.

Senate Republicans killed the proposal.

Experts say there’s a fine line between a tax and a fee and what is palatable and what is not.

Chris Edwards, director of tax policy at the conservative Cato Institute, said there are no hard and fast definitions for these terms that people of all political persuasions will agree upon.

“The broader question is, what is the right size of the government there,” he said.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy